The unprecedented surge in share prices of companies investing in artificial intelligence today bears a striking resemblance to the California Gold Rush of the late 19th century. That historic rush, while filled with tales of fortune, ultimately favored not the miners themselves but those who supplied them with picks, shovels, and essential infrastructure.

Similarly, the contemporary AI boom may ultimately favor the providers of core infrastructure and renewable energy over the flashy creators of AI software.

Among these providers, U.K.-based renewable energy and infrastructure investment trusts have emerged as an undervalued yet profitable haven, offering compelling opportunities that North American investors have largely overlooked.

Drawing Parallels: The AI Boom and the Gold Rush

The AI sector, led by major technology companies such as Nvidia, Microsoft, Google and Meta, has witnessed a meteoric rise in valuation as the world races to harness AI’s power. However, despite the success of the ‘Magnificent Seven’ — and much like the gold rush miners who faced significant risks and few rewards — investing directly in speculative AI startups or software platforms carries high volatility and uncertainty.

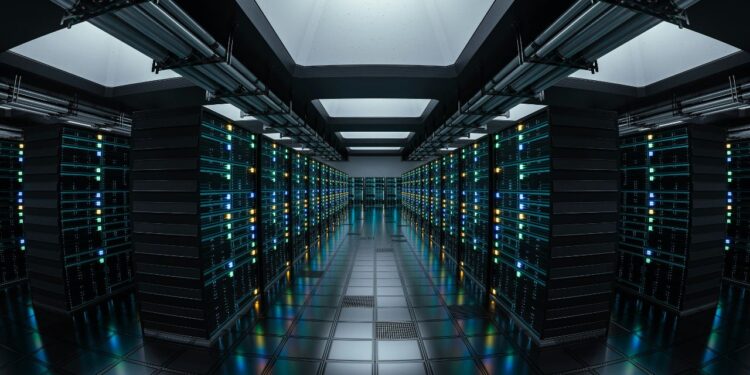

The real wealth may in fact lie in infrastructure: the network of data centers, cloud computing platforms, semiconductors, and, crucially, the renewable power that fuels AI workloads. These foundational layers are the backbone of AI’s explosive growth curve.

For instance, hyperscale cloud providers and private equity firms are collectively committing hundreds of billions of dollars to build and modernize AI-centric data centers capable of handling the intensive computational power AI demands.

This is reminiscent of the Gold Rush suppliers who profited steadily by provisioning the boom selling picks and shovels rather than chasing elusive gold seams.

The Scale of AI Infrastructure Investment

The scale of AI infrastructure spending is staggering and escalating rapidly. In 2025 alone, the four largest hyperscale operators — Amazon, Google, Microsoft, and Meta — are expected to spend upwards of $350 billion on capital expenditures dedicated to AI infrastructure, marking a massive year-over-year increase.

Additionally, initiatives like the Stargate Project, a $500 billion private-sector AI data center boom spearheaded by OpenAI, Softbank, Oracle, and Microsoft, are constructing dozens of cutting-edge facilities in the United States, creating tens of thousands of jobs and fostering economic growth tied directly to AI readiness.

These investments are not limited to equipment or technology; power demands are mounting, and as AI computation scales, the need for renewable energy grows more urgent.

Sustainable power solutions serve a dual purpose: they keep AI operations viable in a carbon-conscious world and hedge against energy cost volatility.

This convergence of digital and physical infrastructure creates significant openings for investors with foresight.

Why U.K. Renewable Energy and Infrastructure Trusts?

While North American markets have been the epicentre of AI infrastructure spending and speculative excitement, U.K. renewable energy and infrastructure investment trusts represent an underappreciated global opportunity.

These trusts specialize in owning and operating critical renewable energy assets and infrastructure projects that supply the power and connectivity indispensable for AI and cloud computing growth.

Several factors highlight the attractiveness of U.K. trusts:

- Undervaluation and Discounts: Many of these trusts are trading at discounts to their net asset values (NAVs), despite consistent profitability and attractive dividend yields. This signals market inefficiency where capacity for stable returns is undervalued relative to growth prospects.

- Stable Income Generation: Unlike volatile AI software stocks, renewables and infrastructure trusts generate predictable, regulated income streams. This feature appeals strongly to income-seeking investors, especially in uncertain macroeconomic conditions.

- Positive Sector Trends: The U.K. government and EU initiatives emphasize expanding renewable energy capacity and modern infrastructure to meet climate and digital transformation goals. This regulatory tailwind supports long-term asset value growth and operational stability.

- Valuation Gap Closing Yet Unexploited: While the valuation gap between U.S. and U.K. equity markets has narrowed as U.S. investors bought FTSE 100 stocks, the niche of renewables and infrastructure trusts remains comparatively overlooked. This gap offers a potential first-mover advantage to investors willing to explore outside the mainstream U.S. tech infrastructure markets.

Hedge Fund Interest as a Validation Signal

The rising institutional interest in U.K. investment trusts bolsters confidence in this opportunity.

Saba Capital Management, a prominent U.S. hedge fund, has been acquiring significant stakes in U.K. generalist investment trusts, signalling belief in their undervalued nature and resilience. Saba is also planning to launch an ETF targeting U.K. investment trusts, highlighting the growing recognition of U.K. infrastructure trusts’ potential as AI-related investments.

This influx of specialized capital may also serve as a catalyst for re-rating these assets upward, unlocking value for existing investors. Hedge funds often identify structural inefficiencies and underappreciated opportunities, and their involvement generally encourages wider market participation.

A Compelling Investment Option

In summary, the AI gold rush of the 2020s mirrors the California Gold Rush in that the greatest profits may come not from chasing AI gold directly but by investing in the durable, essential infrastructure and renewable energy that sustain AI.

While North American investors aggressively chase AI stocks and infrastructure, U.K. renewable energy and infrastructure trusts present an attractive, undervalued alternative with strong fundamentals, dividends, and regulatory support.

The combination of rising AI-driven demand, beneficial government policies, and ongoing undervaluation offers a compelling investment theme. Furthermore, institutional interest from hedge funds like Saba Capital Management underscores the opportunity’s validity.

As the AI economy expands, diversifying into U.K. trusts focused on renewables and infrastructure can provide strategic exposure to AI growth with lower volatility and income potential.

Investors looking beyond the hype should evaluate these trusts as critical components of an AI-era portfolio, capturing value from the boom’s infrastructure while mitigating the risks characteristic of bubble-prone technology stocks.

NextEnergy Solar Fund Ltd (LSE:NESF): Offering a dividend yield of approximately 11.2%, this trust is trading at about a 35% discount to NAV. It is viewed as a leading player in U.K. solar energy infrastructure, with a stable asset base and consistent income generation.

Foresight Solar Fund (LSE:FSFL): This trust targets a dividend yield of around 9.4%, with shares trading near a 20% discount to NAV. Foresight manages a diversified portfolio of solar assets complemented by development pipelines, with a focus on long-term reliable dividend income.

Greencoat UK Wind (LSE:UKW): Known for its high dividend yield around 8.8% and a discount to NAV near 22%, this trust invests in onshore wind farms across the U.K. It is favored for its steady cash flows despite market volatility that has widened its discount.

Renewables Infrastructure Group (LSE:TRIG): TRIG has a dividend yield near 8.5%, supported by a high-quality diversified portfolio, currently trading on a significant discount. The trust benefits from proprietary development pipelines but faces macroeconomic uncertainties that have affected its NAV discount persistence.

These trusts commonly trade at discounts ranging from approximately 15% to over 20% relative to their net asset values, reflecting market uncertainty, policy changes, and inflation-linked subsidy adjustments in the U.K. renewable sector.

Despite these discounts, most offer strong dividend yields from around 5% up to over 11%, reflecting their ability to generate stable cash flows from long-term infrastructure assets.

For investors seeking exposure to the AI-driven infrastructure demand, these U.K. renewable energy and infrastructure trusts present a favorable combination of income and discounted valuations, offering a counterbalance to the volatility seen in AI software equities.

The discounts imply a margin of safety in entry valuations, while dividend yields provide attractive income streams aligned with essential green energy infrastructure needed to power expanding AI data centres and digital economies.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Allwork.Space. This article is for informational purposes only and does not constitute financial advice.