WeWork’s financial model has long been a topic of debate, with various experts worrying that WeWork is creating a bubble that is bound to burst.

“It is just not possible to grow that aggressively…and maintain those sorts of margins. I honestly think it’s a bubble.” – David Alberto, former Managing Director at Avanta.

WeWork’s valuation is set above the whopping amount of US$20 billion, and as the coworking giant continues to aggressively expand across the globe, more people are starting to become wary about their financial model and how it can impact the industry.

If we oversimplify it, we can say that WeWork’s model is so attractive because it brings in profit and revenue in the short-term. Yet, there are no long-term guarantees, hence the high-risk associated with their business model. But the risk is theirs and that of the investors, right?

Well, not exactly. If WeWork is indeed creating a bubble, then the moment that bubble bursts, everyone in the industry — including large and small operators, as well as CRE owners — will suffer the consequences.

Recently, we published an article about WeWork’s arrival in Brazil, and how it has unleashed a dog-eat-dog type of competition among Brazilian workspace operators. Though this in itself has raised concerns among many, we recently received a report hinting that concerns in Brazil go beyond the increased aggressiveness in competition.

* The information used below was taken out of a report created by an international brokerage firm with clients in Brazil that were interested in WeWork.

WeWork is currently operating one space in Sao Paulo, and is planning on opening at least 5 more in the South American country in the near future.

The main concern of the report sent to us is whether or not the company’s high valuation and optimistic projections appropriately reflect the reality it faces in its daily operations.

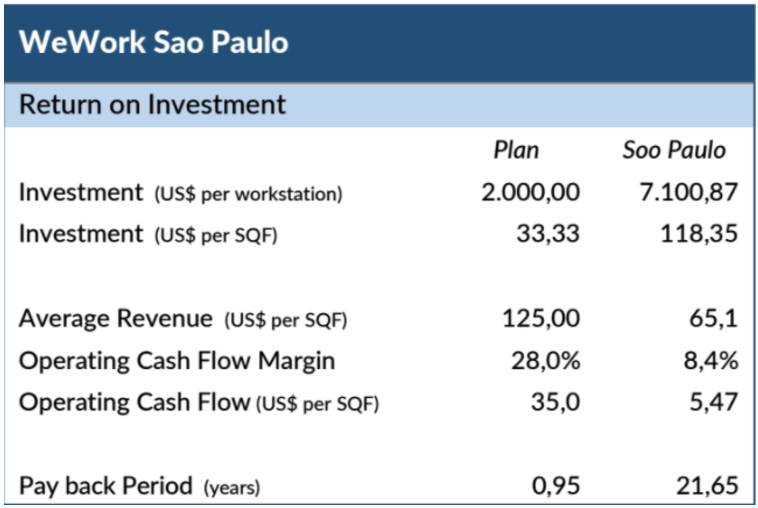

Back in 2015, WeWork documents were leaked to the public that stated that landlords agree to pay about 75% of the capital expenditure required to refurbish and furnish the leased space. The same leaked documents also stated that WeWork’s business would generate 28% operating cash flow margin.

In Brazil, at least for the time being with its only operating location, this is not the case.

According to the report sent to us, WeWork has spent approximately 2 years in talks with local landlords trying, without success, to implement a lease model where the landlords would put up much of the capital required for refurbishing and furnishing the offices. For Sao Paulo, sources confirmed that WeWork’s landlord did not agree to pay any tenant allowance.

Additionally, WeWork’s prices in Brazil–as Matias Velazquez told us recently–reached the (low) point of dumping. WeWork is asking for BRL 1,100 for a dedicated desk (US$ 350), which in the current state of Brazil’s market, translates into slim profits and a low-probability of generating adequate return on the invested capital. Considering WeWork was not able to obtain the 75% allowance they expected from their landlord, this means their invested capital is at least 4 times greater than what they had planned.

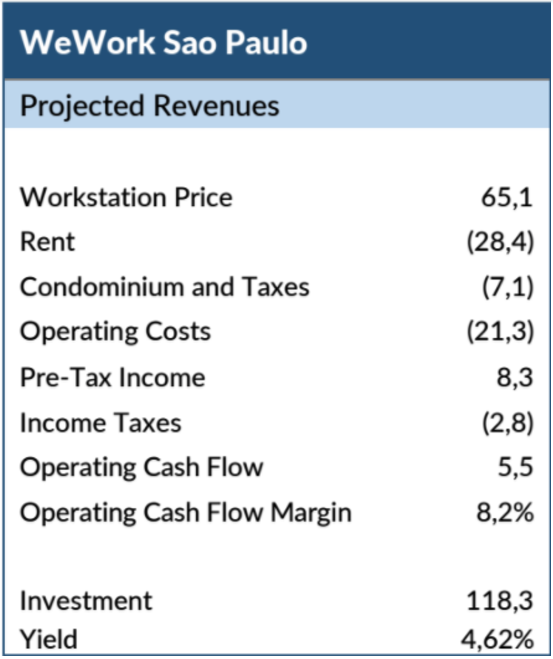

According to the calculations of a financial analyst that worked on the report, the annual operating cash flow that WeWork will generate in Brazil will be of approximately US$5 per square foot.

WeWork’s 2014 leaked Pitch Deck showed that the company calculated a payback period ranging from 7 to 22 months. In the case of Brazil, analysts believe WeWork’s payback period will be of approximately 20 years.

All of this begs the question (yet again) of whether or not WeWork’s valuation is warranted based on the actual reality of its business performance.

If WeWork’s bubble bursts, then the entire industry will be hit with a devastating blow, especially small and local operators seeking to raise capital. Furthermore, it could potentially spoil the industry’s relationship with property owners.

We are wondering, isn’t it about time WeWork shares its numbers, openly and willingly to the public? If indeed we are in the midst of a growing bubble, shouldn’t we all know?

A couple of months ago, WeWork’s Adam Neumann confirmed that the company will eventually go public. This means that at some point WeWork will have to share its numbers and be open to scrutiny. Yet, when and where WeWork will be listed remains to be disclosed, meaning that for the time being we all remain in the dark whether or not WeWork is actually doing what it says it’s doing.