- According to the latest UK provider sentiment survey from Workthere, contract occupancy in flexible office space has stabilised one year on from the start of lockdown.

- Occupancy levels have leveled out at 66% in March 2021.

- The survey also shows that the percentage of occupiers asking for rent relief has dropped dramatically year-on-year.

According to the latest UK provider sentiment survey from Workthere, contract occupancy in flexible office space has stabilised one year on from the start of lockdown.

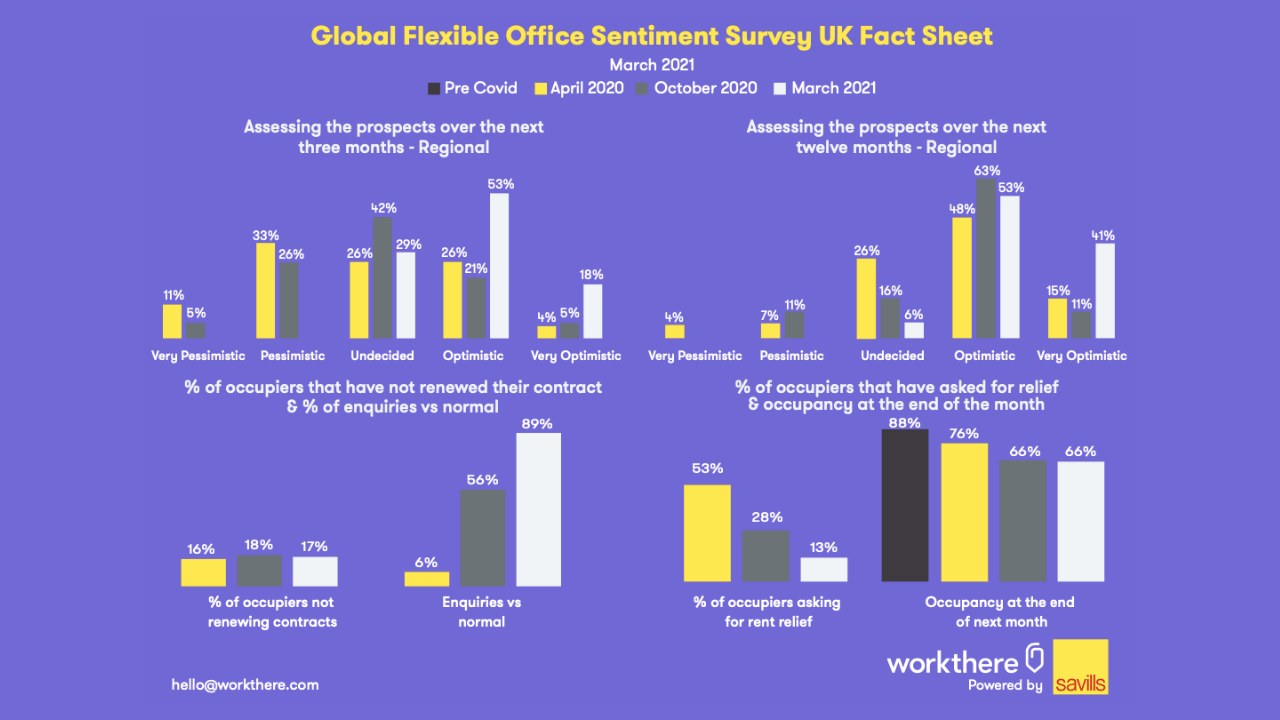

Occupancy levels have leveled out at 66% in March 2021, the same level as in the flexible office specialist’s survey in October 2020. This is down from 80% level pre-Covid back in early March last year.

The occupancy level is expected to begin bouncing back over the coming months with enquiries now up to 89% of the pre-Covid level, compared with 8% in March last year, and 56% in October 2020, a clear indication that companies are preparing to return to normal working patterns.

The survey also shows that the percentage of occupiers asking for rent relief has dropped dramatically year-on-year falling from 53% in April 2020 to 13% in March 2021. This is a significant drop from the 28% recorded in October 2020.

Jack Williamson, UK head of Workthere, comments: “What we are seeing here is that, despite the UK still being in a national lockdown, there are green shoots of recovery indicating a slow return to normality. The vaccine roll-out to date and roadmap out of lockdown has certainly helped businesses prepare for how and when they will return to the office. As such, we have seen enquiries and subsequently deals steadily increase in the first three months of the year and, as confidence grows, we expect a steady increase in providers overall occupancy figures from the base of 66% seen between the end of 2020 and up to now.”

Dan Jones, global research analyst, Workthere, added: “With many companies looking at returning to the office, we are seeing the traditional demographic of startups and scale-ups (who each account for 18% of demand) being accompanied by corporates who are looking to diversify their real estate portfolio (6% of enquires). For those companies who are hoping to adopt a more nimble approach going forwards via the hub and spoke model, flexible office space will undoubtedly become a very important component in their future property provision.”

The sentiment survey also indicates that the percentage of providers who are optimistic or very optimistic about the next three months has risen from 26% in October 2020 to 71%, with this figure rising from 74% to 94% for the next 12 months.

* this is in comparison to 88% pre-Covid-19