Despite headlines suggesting a mass return to the office, the reality on the ground tells a different story: just 33% of U.S. companies currently require full-time office attendance, a figure largely unchanged since mid-2024. Instead, hybrid work remains dominant, especially among large employers, even as some Fortune 500 firms shift toward more office-centric policies, according to the new Flex Report Q2 2025.

Flexibility Persists, But With Structure

Two-thirds (67%) of U.S. companies now offer some form of location flexibility, a notable increase from 51% in early 2023. The rise of structured hybrid models (where employees are expected in the office a set number of days per week) is driving this. These models now account for 43% of U.S. firms, more than doubling since Q1 2023.

The dominant pattern within these hybrid setups is clear: 66% of hybrid companies now require employees in the office three days a week, up from 53% a year ago. Nationally, this has pushed the average in-office expectation to 2.82 days per week, up from 2.49 days last year.

Company Size Predicts Flexibility

A firm’s approach to work flexibility is closely tied to its size:

- 70% of large enterprises (25,000+ employees) now follow structured hybrid models.

- In contrast, 70% of small businesses (under 500 employees) offer fully flexible arrangements (no set office days required).

- Only 12% of large companies remain fully flexible, showing a sharp divergence between the biggest and smallest employers.

Big Companies Are Tightening the Screws

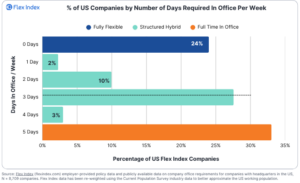

The most dramatic policy transformations have occurred among Fortune 500 firms. The percentage requiring full-time office attendance has nearly doubled, from 13% in late 2024 to 24% in mid-2025. Their average weekly in-office requirement rose from 2.3 to 2.9 days.

Meanwhile, flexibility has declined among Fortune 500 firms, with 76% now offering it compared to 87% a year ago. The most notable movement is away from “employee choice” models, where workers pick their own office days, down from 13% to 7%.

Structured hybrid models with minimum days (not specific days) are now the norm. 80% of hybrid companies use this approach, while those requiring specific days of the week dropped from 17% to just 10%.

Office Mandates Outpace Actual Attendance

While required office days have increased 10% since early 2024, actual in-person attendance has only edged up 1–2%, revealing a persistent compliance gap. Mandates alone aren’t pulling workers back in large numbers.

Industry Breakdown: Who’s Flexible and Who’s Not

Most Flexible Industries:

- Technology (95%)

- Insurance (91%)

- Financial Services (83%)

- Professional Services (83%)

- Media & Entertainment (82%)

Least Flexible Industries:

- Restaurants & Food Services (53% full-time office)

- Education (50%)

- Hospitality (47%)

- Transportation & Automotive (45%)

- Real Estate, Facilities & Construction (40%)

Notably, Tech’s flexibility now depends on company size. Smaller tech firms (under 500 employees) remain overwhelmingly flexible (90%), but larger tech companies now mirror the rest of Big Enterprise, increasingly adopting structured hybrid or full time in office policies.While media narratives may emphasize a return to the office, most U.S. companies remain flexible, just more structured than before. The future of work is hybrid, nuanced, and shaped by company size, industry, and evolving expectations.