Commercial real estate leaders are showing a cautious optimism heading into 2025, according to Deloitte’s latest survey of 850 executives. While enthusiasm has cooled slightly from last year, the majority still expect the market to improve, particularly in revenues and key market conditions like rental rates and leasing activity, according to BisNow.

Capital Availability Takes Center Stage

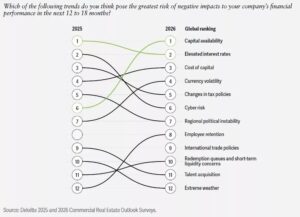

This year, concerns over capital availability have risen to the top of investors’ minds, overtaking interest rates as the biggest potential hurdle.

Courtesy of Deloitte. A graph from Deloitte’s survey shows areas of concern that CRE investors have for 2026 compared to 2025.

Despite this, early signs point to increased capital flowing into the market. New loan volumes surged by 90% in the first quarter compared to last year, mortgage spreads tightened, and commercial mortgage-backed securities (CMBS) originations have more than doubled.

With roughly $585 billion ready to be deployed in real estate investments, funding looks more accessible — especially for new loans — than it has been in recent years.

A Tale of Two Debt Markets

The survey highlights a split in the debt market between legacy loans coming due and new borrowing opportunities. Over half of executives have property loans maturing soon, with many planning to refinance, extend, or modify their loans, while a smaller share anticipates paying off loans in full.

Some expect foreclosures, particularly in the office sector where property values have declined. However, these situations open doors for investors bringing fresh capital into the market.

Office Sector Shows Signs of Revival

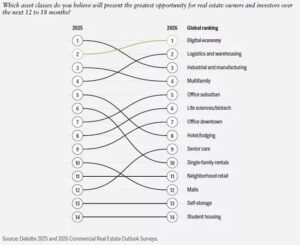

After a period of uncertainty, the office market is regaining investor interest. Both suburban and downtown office assets climbed in rankings as attractive opportunities over the next 12 to 18 months.

Falling prices — sometimes down 50% from peak levels — and the return to in-person work are driving renewed confidence. Transaction data supports this trend, with office sales increasing 42% year-over-year in the first half of 2025.

Digital Economy Assets Lead the Way

Topping the list of favored property types are digital economy assets, such as data centers. These facilities have seen massive investments from tech giants fueling the AI boom, making them the hottest sector in commercial real estate right now.

Courtesy of Deloitte. A graph from Deloitte’s report shows the asset classes where investors see the most opportunity going forward.

AI Integration Brings Challenges and Targeted Wins

Artificial intelligence continues to shape the industry, but executives report growing pains. Challenges around technical issues, expertise gaps, and adoption resistance have increased compared to last year.

Fewer leaders now describe AI as transformative across the board, with success more apparent in specific areas like tenant relationship management, construction, and lease drafting. The message is clear: AI requires focused application to boost efficiency and deliver value.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert