The Global Workspace Association’s annual Flex Forward Conference brought together some of the industry’s most influential voices — but few sessions captured the mood of the market quite like the “State of the Flex Industry” keynote, featuring Ben Wright, Global Head of Partnerships at The Instant Group, and Mark Gilbreath, CEO of LiquidSpace.

From enterprise growth to small-town demand, their data-packed session revealed the real dynamics shaping flexible workspace in 2025, and what’s next for operators, landlords, and occupiers alike.

Here are the seven biggest takeaways from the GWA stage — complete with hard data, context, and what it means for the future of work.

1. Hybrid Work Is the New Normal, and Demand Is Finally Predictable

1. Hybrid Work Is the New Normal, and Demand Is Finally Predictable

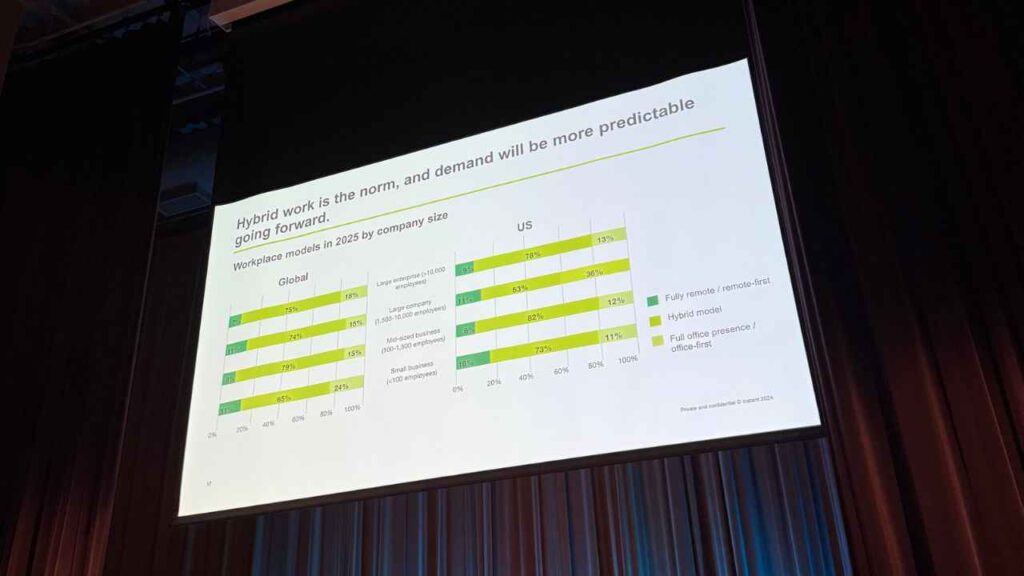

After years of volatility, hybrid work has become the baseline model worldwide. The Instant Group’s data shows that across company sizes, hybrid setups dominate both globally and in the U.S., with over 60% of organizations adopting hybrid models versus just 13% fully remote.

This stabilization means operators can now forecast occupancy with greater accuracy. “Hybrid work is making demand more predictable,” noted Wright, adding that flexibility has moved from trend to infrastructure.

Why it matters: Predictability fuels investment confidence, and that’s exactly what the flex sector needs to scale sustainably.

2. Enterprise Flex Is No Longer an Experiment, But a Strategy

2. Enterprise Flex Is No Longer an Experiment, But a Strategy

Compelling evidence was presented showing that enterprise adoption of flexible workspace is accelerating at record pace. Between 2022 and 2025, enterprise flex usage grew at a 170% compound annual growth rate (CAGR), with large organizations now representing 72% of all on-demand workspace volume (up from just 20% in 2022).

The experiment is over. Flex is now a core part of enterprise portfolio strategy.

Why it matters: Operators catering to enterprise clients — with scalable tech, security, and brand-consistent experiences — are positioned to lead the next era of growth.

3. The New Enterprise Balance: Flex Up, Fixed Down

3. The New Enterprise Balance: Flex Up, Fixed Down

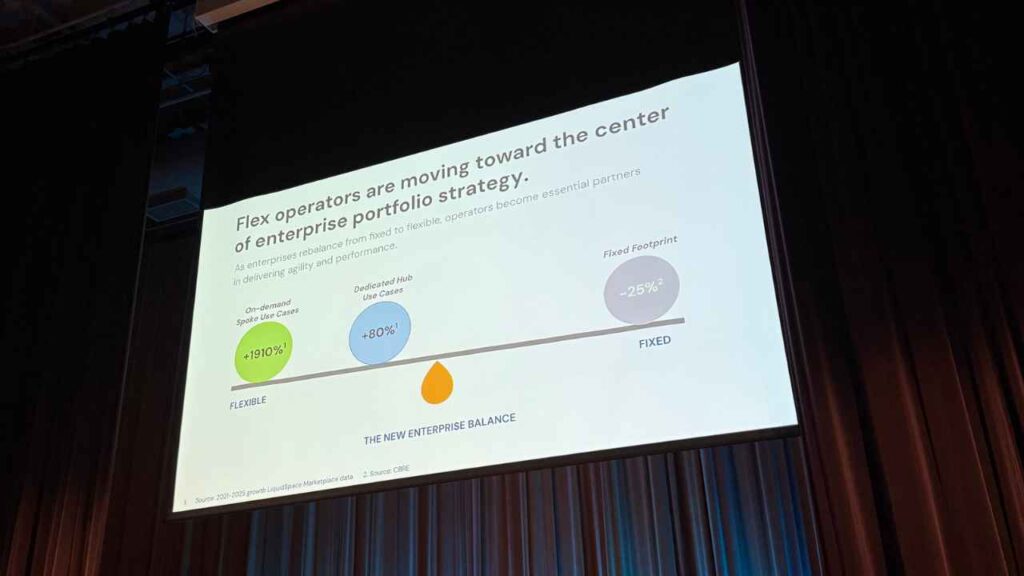

In what both speakers called the “new enterprise balance,” corporations are shrinking fixed footprints and expanding flexible hubs to optimize costs and agility.

- On-demand spokes/hubs: +910% growth

- Core use cases (satellite offices): +80%

- Fixed office footprint: −25%

Operators are moving toward the center of enterprise portfolio strategy. They’re no longer on the fringe; they’re integral.

Why it matters: This shift cements flex providers as strategic partners to corporate real estate teams, not just landlords of last resort.

4. Flex Supply Can’t Keep Up with Demand Globally

4. Flex Supply Can’t Keep Up with Demand Globally

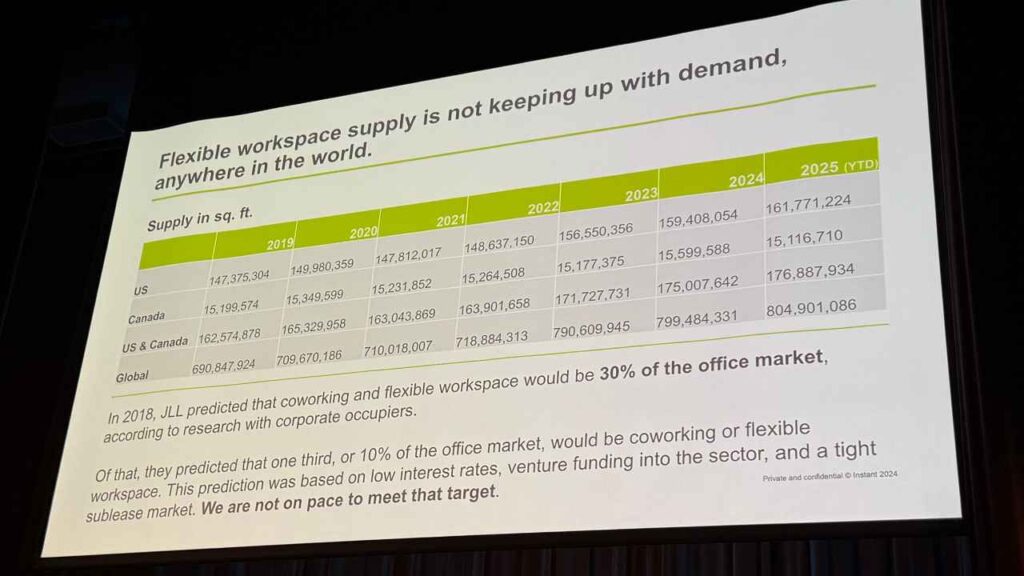

Despite this explosion in enterprise use, the global supply of flexible workspace is lagging. Instant Group’s figures show:

- Global supply (2025 YTD): 804 million sq. ft.

- US + Canada: 176 million sq. ft.

- JLL’s 2018 forecast: Predicted flex would make up 30% of the office market by now, but “we are not on pace to meet that target,” Wright confirmed.

High interest rates, tight sublease markets, and slower buildouts have all contributed to the bottleneck.

Why it matters: Expect rent premiums to rise in prime markets and opportunities to open for smaller operators who can move faster.

5. Demand Is Exploding in Smaller Cities and Towns

5. Demand Is Exploding in Smaller Cities and Towns

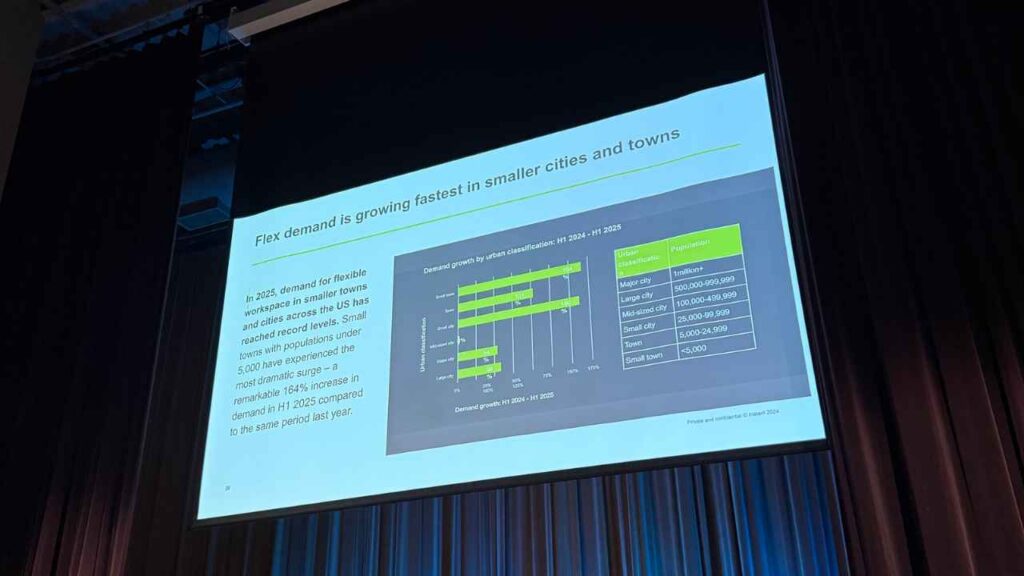

One of the most striking trends: flex demand is growing fastest outside major metros.

In the U.S., towns under 5,000 people saw a 146% increase in demand in the first half of 2025 compared to 2024. Mid-size and small cities also posted double-digit growth, showing that distributed work is fueling hyperlocal workspace ecosystems.

Why it matters: The future of flex isn’t just urban — it’s everywhere. Operators who can replicate brand quality and community at local scale will win the next growth wave.

6. Landlords Are Becoming Flex Providers

6. Landlords Are Becoming Flex Providers

The speakers underscored a major structural shift: the supply of flexible workspace is becoming more landlord-driven.

Expect to see more:

- Subleased offices

- Spec suites

- Amenity floors

- Meeting rooms as rentable assets

At the same time, landlords are grappling with higher interest rates and historically low office investment, prompting them to integrate flexibility directly into their portfolios.

Why it matters: Traditional operators may find themselves competing (or partnering) with landlords entering the market. Strategic alliances will be key.

7. There’s Still Room for Small and Mid-Sized Operators

Despite consolidation at the top, the panel emphasized that small and mid-sized operators remain vital to the ecosystem.

“There are still rent premiums to be had in flexible workspace,” one slide read, emphasizing that local, relationship-based operators are better suited to serve niche communities — and that the business remains inherently local.

Why it matters: Human connection, design, and hospitality still differentiate small operators. Those who double down on community and service will remain competitive against giants.

The Bottom Line: The Flex Industry Has Matured, and It’s Only Getting Started

From hybrid stability to enterprise-scale demand, 2025 marks a turning point for the flex industry. The data presented at GWA’s conference suggests that flex is no longer a niche category, but instead a central pillar of global workplace strategy.

From hybrid stability to enterprise-scale demand, 2025 marks a turning point for the flex industry. The data presented at GWA’s conference suggests that flex is no longer a niche category, but instead a central pillar of global workplace strategy.

But as Wright and Gilbreath made clear, challenges remain: supply shortages, high buildout costs, and market fragmentation. The winners will be those who can balance scale with soul — blending efficiency, locality, and experience in a market that’s finally found its rhythm.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert