After nearly two decades of experimentation, coworking operators are rethinking what actually drives sustainable revenue.

This Week In Coworking did a deep dive into what factors may influence coworking businesses, and interviewed many key players to find the answer.

Interviews with operators (The Shop Workspace, 25N Coworking, Narra Collective, Piloto 151, Cubes.co, and Bond Collective) across the U.S., Australia, and Puerto Rico point to a clear shift: private offices still dominate income, but growth is increasingly coming from services, add-ons, and business lines that extend far beyond desks and square footage.

This emerging approach — often described as a “new revenue stack” — reflects changing expectations around workspace, hospitality, and flexibility, as well as hard lessons learned about margins, labor, and scalability.

The 2025 Revenue Stack, by the Numbers

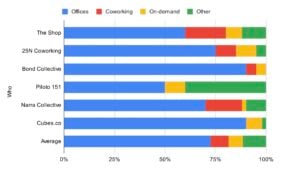

Across a cross-section of independent and multi-location operators, private offices still account for roughly 72.5% of total revenue. The remaining share, however, tells the more interesting story.

Traditional coworking memberships now average under 9% of revenue, nearly matched by on-demand products like meeting rooms, day offices, and event space. The fastest-growing category is a broad “other” segment — about 11.5% of revenue — made up of newer, often unbundled offerings that were not historically core to coworking.

These figures suggest that while offices remain foundational, operators are increasingly reliant on revenue streams not tied directly to occupancy.

Image credit: This Week In Coworking

Hospitality Is Becoming a Billable Product

One of the clearest changes is the monetization of hospitality services. Rather than treating food, beverage, and concierge support as sunk costs, operators are packaging them as paid add-ons tied to meetings, events, and short-term bookings.

Examples include catered meeting packages, administrative fees for food coordination, beverage passes, concierge-style errands, and managed experiences for offsites or trainings. These services often carry strong margins because they leverage existing staff skills and vendor relationships rather than additional real estate.

Operators report that clients — especially corporate teams — are willing to pay for simplicity, particularly when planning falls outside their core job responsibilities.

Virtual Services Are No Longer Secondary

Virtual offices, mail handling, and business address services have emerged as some of the most scalable revenue lines in coworking. In several portfolios, virtual products now generate revenue comparable to smaller physical locations, despite requiring little or no additional space.

A key evolution has been the unbundling and repricing of virtual services. Operators are increasingly charging separately for mail volume, additional business entities, phone answering, and meeting room access.

Discounted pricing for multiple entities has proven especially effective, capturing revenue from serial entrepreneurs without discouraging usage.

In many cases, virtual customers serve as an entry point into the broader ecosystem, later converting into physical memberships.

Events, Production, and Short-Term Use Are Filling Gaps

Event space has become a meaningful revenue driver, particularly where operators introduce memberships or packages for repeat organizers. Predictable usage from workshops, community groups, and corporate programming helps smooth volatility while activating space outside standard work hours.

Some operators are also seeing increased demand from film, television, and production teams, who rent offices or suites for short-term use as writing rooms, staging areas, or sets. These bookings often occur mid-month, filling inventory that would otherwise sit vacant and generating competitive rates with minimal sales friction.

Daily office rentals — temporary private suites offered by the day — are another growing category, appealing to hybrid teams, visiting executives, and local companies seeking occasional privacy.

Revenue Is Expanding Beyond the Member Base

A notable trend is the expansion of services beyond coworking members altogether. Operators are increasingly managing shared amenities, conference centers, and community programming on behalf of landlords, residential buildings, and mixed-use campuses.

In these arrangements, coworking teams provide operational expertise, staffing, and programming while landlords retain ownership of the space. This model allows operators to generate revenue without assuming lease risk and positions coworking as a service layer within larger real estate portfolios.

Some operators are also acting as the “front door” for larger tenants, handling reception, meetings, and events so those companies can reduce their own footprint.

Not All Revenue Is Worth Chasing

Despite experimentation, operators report consistent underperformance in certain areas. Attempts to monetize basic hospitality — such as charging for small conveniences — often backfire and damage member goodwill. Services that consume disproportionate staff time, particularly mail handling when poorly automated or priced, can erode margins despite steady demand.

Dedicated desks have also largely fallen out of favor post-pandemic, with demand shifting toward either flexible access or fully private space. Day passes, while useful for lead generation, frequently fail to convert or align with community-driven models unless structured carefully.

These experiences are pushing operators to evaluate revenue not just by topline contribution, but by labor intensity, operational friction, and long-term impact on member relationships.

Several forces are converging:

- Higher labor costs are forcing closer scrutiny of staff-intensive services

- Member expectations increasingly favor flexibility and bundled experiences

- Hybrid work has reduced demand for certain legacy products

- Technology is enabling more precise pricing, packaging, and tracking

Across regions and operator sizes, the same patterns are emerging, suggesting this is not a niche evolution but a structural one.

The Direction Ahead

The takeaway from operators is consistent: the future of coworking revenue lies less in adding desks and more in increasing lifetime value per customer. That means recurring memberships, scalable services, and products that are decoupled from square footage.

While private offices remain the economic backbone, the industry’s growth — and resilience — is increasingly coming from everything built around them.