Office buildings today are rich with amenities. Rooftop terraces offer panoramic views, fitness centers anchor wellness programs, cafés and lounges provide a reprieve, and pickleball courts and gyms bring energy to the workplace. These features help buildings compete for tenants and shape the identity of an asset. They also play a material role in the economics of commercial real estate, because amenities flow into the rentable square footage of a building through the BOMA Office Standard (ANSI/BOMA Z65.1-2024).

In other words, amenities matter because they participate directly in the math of leasing.

There is, however, an emerging category that has not yet been incorporated into this system of calculating value, even though it now supports the way people work every day. The shared components of flexible workspace — open lounges, meeting rooms, work cafés, shared kitchens, and collaboration zones — are central to the rhythms of hybrid work.

They strengthen coordination, support team rituals, and accommodate visiting colleagues. They serve as social infrastructure for the entire building. In practice, they behave like amenities, even when they are not recognized that way in the financial model.

The Shared Flex Components That Already Look Like Amenities

Many contemporary offices include generous communal spaces accessible to employees from multiple companies: hospitality-inspired lounges, shared kitchens, on-demand meeting rooms, and project spaces designed for quick collaboration. These environments often mirror the look, purpose, and usage patterns of the amenity floors landlords have built over the past decade.

They activate the building throughout the day, encourage interaction, and fill in the gaps created by hybrid schedules.

The resemblance to traditional amenities is unmistakable. A shared coworking lounge performs the same function as a tenant commons. A flex café supports the same kind of informal gathering as a building-wide café. A bank of small meeting rooms echoes the purpose of centralized conference facilities.

These spaces enable meaningful work and shape a building’s experience, yet they often sit outside the amenity structure simply because flex has historically been categorized as a business model rather than a building asset.

How the Measurement Standard Supports This Change

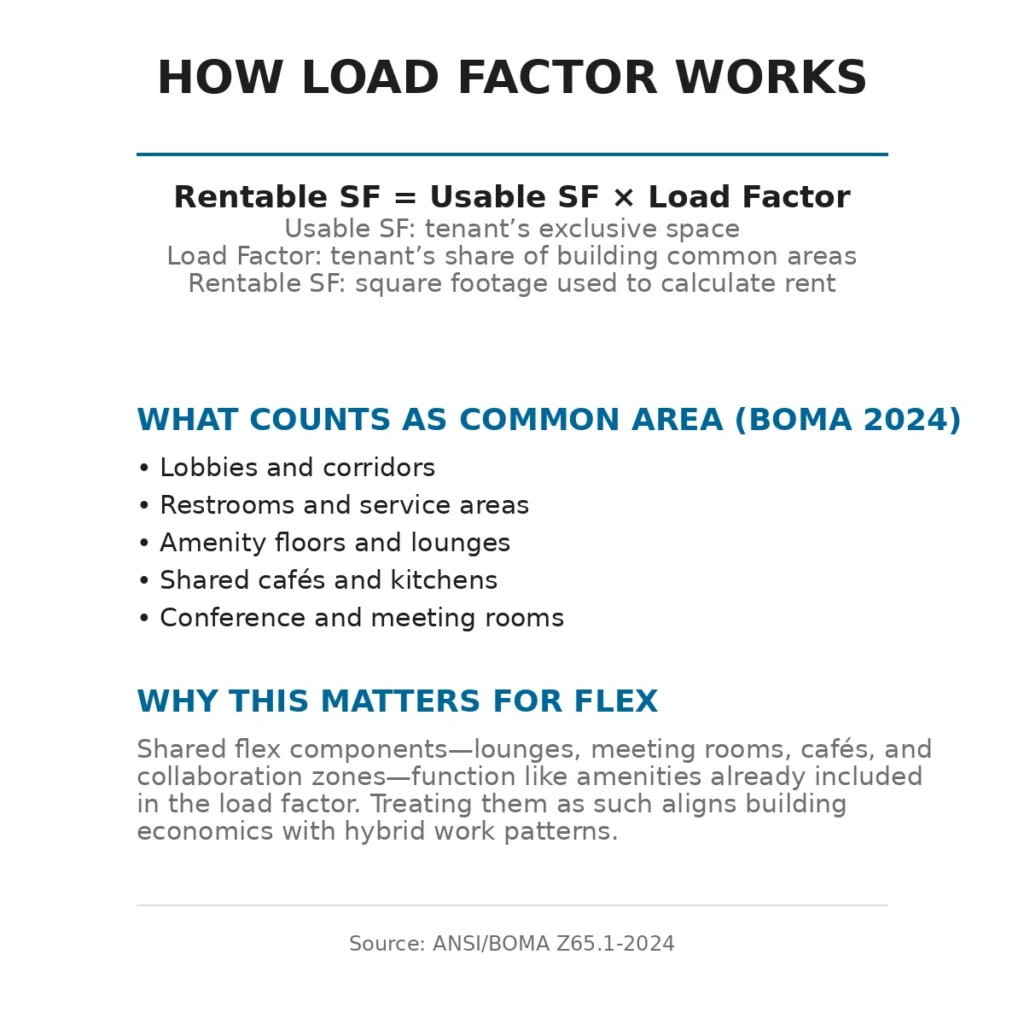

The BOMA Office Standard establishes how a tenant’s rent is calculated. Rentable square footage includes the usable area inside a tenant’s premises plus a proportionate share of the building’s common areas. Lounges, shared cafés, amenity floors, and conference centers form part of the load factor because they improve the building’s utility for everyone.

The standard also explains how these shared areas can be apportioned across tenants in a consistent manner.

This framework already accommodates the spaces that make up the shared components of flex. Under the BOMA definitions, any area that supports multiple tenants and contributes to the building’s operating ecosystem can be treated as a common amenity.

The interpretive aids provided by industry practitioners reinforce that meeting rooms, collaboration zones, lounges, cafés, and similar shared environments belong inside the calculation.

Tenant Demand Has Shifted, and Amenities Must Support Work

Tenant Demand Has Shifted, and Amenities Must Support Work

Tenant priorities have evolved. Research from JLL shows that office environments designed around collaboration, social interaction, culture, and connectivity are now central to employee productivity and satisfaction, making experience-rich shared spaces critical to leasing outcomes.

Data from the Gensler Research Institute’s 2025 Global Workplace Survey reveals that time spent working with others in person continues to increase and that human-centered design — including access to shared, flexible environments — strengthens team performance and workplace experience.

Additional Gensler research on hybrid work demonstrates that employees consistently value in-office collaboration and social interaction, reinforcing the importance of amenities that support those activities.

A Model That Fits Both New Leases and Renewals

Incorporating shared flex components into the load factor aligns the financial treatment of these spaces with their role in the building.

This structure can be introduced during new lease negotiations or built into renewal packages. Tenants gain access to collaboration-ready environments without oversizing their private suites. Landlords gain a more efficient floorplate and a more competitive asset.

Embedding flex amenities into the rentable area also enables owners to invest in these spaces using the same capital logic applied to gyms, tenant lounges, or conference centers. The value is captured in the building’s performance — occupancy, retention, tenant satisfaction — rather than in a standalone operating profit.

Why the Market Hasn’t Changed — Yet

The hesitation around treating flex as part of the amenity stack is rooted less in demand and more in classification.

As asset owners increasingly re-thinking the product mix within the asset to include more than just long-term, fixed leases, Flex fits naturally into that spectrum. The challenge is that the capital frameworks surrounding office buildings have not yet established a clear category for where flex belongs within that mix.

Underwriting models still expect space to fall neatly into one of two definitions: revenue-producing leased premises, or conventional common areas. Shared flex environments sit between those boundaries, and anything that doesn’t align with legacy templates is approached cautiously by lenders and appraisers.

In my recent Allwork.Space analysis, “Follow The Money: Why Capital Markets Are Slowing the Office Reset,” I examined how the financial architecture behind office assets often lags behind the evolution of work. Flex reflects that gap directly.

Landlords are increasingly recognizing how these spaces enhance their assets; however, they are struggling to place them inside a system that has not yet created a standardized category for them. Until capital markets establish a clear method for valuing shared flex components within the rentable area model, adoption will move slower than tenant demand.

The Full-Stack Office Asset

A high-performing office asset no longer offers one product; it offers a complete spectrum of workplace experiences.

Traditional amenities provide comfort, wellness, and hospitality. Shared collaboration environments create the connective layer for hybrid work. Turnkey suites help tenants flex capacity without friction. Long-term leases anchor the core business. Together, these layers form a full-stack office ecosystem — coherent, flexible, and aligned with how work actually happens today.

Flex is part of that stack. It enhances the building’s capability, its relevance, and its performance. It strengthens the relationship between the owner and the tenant. And it does so by providing purpose-built spaces that enhance the very activities that make the office valuable.

Hybrid work depends on spaces that bring people together with clarity and purpose. Shared flex environments make that possible. They make the building work as a system. And in that sense, they are not a separate alternative to the office. They are one of the amenities that keep the office alive.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert