by Roy F. Glassberg, CPA is a partner at the New York and Florida-based firm, Roy F. Glassberg, CPA PA. The firm was established in 1966 by Herbert Glassberg, LPA to provide advice and tax preparation services for individuals and businesses with the goals of maximizing a taxpayer’s net after-tax return and minimizing the taxpayer’s risk to negative audit results. Roy can be reached at 561 948-6549 or via email at [email protected].

One of the most frequent questions I get asked as a CPA for Executive Office Centers is “Under which type of entity should I form my Center?” Interestingly, most persons first ask their attorney. These days most attorneys suggest an LLC, which is not always the best answer, at least not from this CPA’s point of view.

My quick answer is that, unless you are non-US individual, you should NOT own your Center in either a Regular Corporation or as an “Unincorporated” entity. (Non US persons should contact your CPA for other alternatives.)

So the choice remains: should you form an LLC or a Sub Chapter S Corporation?

- If your Center(s) are owned solely by one person, then my first thought is to use a Sub Chapter S Corporation. The reason for this is that it gets your business Income and Expenses off of your personal tax return. Fact: A business reported on a personal tax return has historically had the highest chance of being audited, and unless you have a fetish, and like audits, I would discourage you from being a Single Member LLC.

- If you have more than one owner, then the reporting of the detail income and expense tax information is not on your personal tax return. There are, however, still some tax differences between the two: The main difference in taxation of a shareholder of a Sub Chapter S Corporation versus a “member” of an LLC is self employment tax:

- If you are a member in an LLC you pay self employment tax on 100% of your allocated Net Income

- If you are a shareholder in a Sub Chapter S Corporation you pay social security tax ONLY on your salary, NOT on your Net Income after your salary.

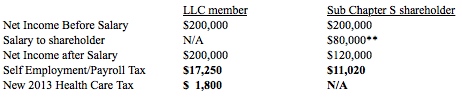

This difference in Self Employment Taxes can be significant every year! Here’s an example:

The above shows an annual savings of $8,030. Of course the salary sample shown above may be higher or lower for you, so review this with your CPA.

Now for the second question: “Is it too late to change my Entity?” The answer is: NO! As a matter of fact, by simply filing the two forms (Possibly three, depending on what State you are in) you can convert the taxation of your LLC to a Sub Chapter S Corporation.

As with all tax questions, you should contact your CPA to see if this large savings is applicable in your situation, or you can simply contact our office.

Have a great month.

Roy F. Glassberg, CPA