Last week, the REDD-Monitor reported that flexible workspace provider Bar Works “has been facing difficulties with its banking facilities”. According to the article, earlier this month (April), Franklin Kinard, Bar Works’ Managing Director, sent a message to investors explaining the ‘banking difficulties’ and how these have led to “a significant increase in banking costs”. The difficulties has also forced the flexible workspace organization to change banking partners.

The issue at hand is not so much the banking difficulties, but the reason behind them and even more importantly, why it’s been necessary for Bar Works Coworking to change banking partners. Is the bank forcing a closure on the account? Has the bank frozen funds? Is Bar Works under investigation? Is the bank concerned about a possible scam? Or has Bar Works Coworking simply run out of money?

For a company that states that they can offer investors a ‘bullet-proof’ model, the current situation raises many questions, casts a doubtful light, and has many hypothesizing about what is truly going on with the coworking company.

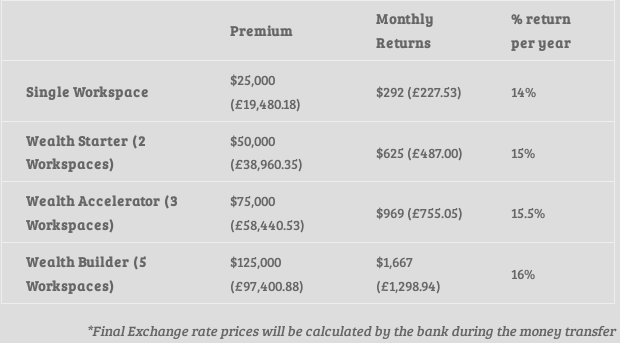

Based on Bar Works ROI model, REDD-Monitor’s theory is that Bar Works could potentially be leading a Ponzi scheme operation.

Investopedia defines a Ponzi scheme as: “a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors.”

Image taken from REDD-Monitor

REDD-Monitor expands on the Ponzi scheme with the following explanation:

“It’s always good to remind ourselves what Offshore Alert’s David Marchant has to say about investment schemes that show this sort of return:

As an investigative reporter, the easiest financial crime for me to detect is a Ponzi scheme. Any investment scheme with a performance chart that is essentially a diagonal line trending upwards with little or no meaningful variation over many months is a Ponzi scheme, and, as such, doomed to failure.”

Whether or not Bar Works is leading a fraudulent operation remains to be seen. Nonetheless, their current banking difficulties are only an early sign that their model isn’t as ‘bullet-proof’ as they made it out to be.

As for the investors, Jonathan Price of Business Centre Capital Co Ltd suggest that they be really careful and do proper due diligence before committing any funds to new and unproven ventures.

Read the full REDD-Monitor article and analysis here.