- WeWork now has the largest volume of space commitments in Central London, ahead of Google and Amazon, and behind only the Government.

- A record 2.5 million sq ft was leased to flexible workspace operators in Central London last year, more than a fifth of total office transactions in the capital.

- The future looks bright for London and regional UK cities, as growth is expected to continue unabated and further intensify the new ‘space race’.

New research released today from Cushman & Wakefield has revealed record growth in demand for flexible workspace across the UK, with WeWork and Spaces leading the charge.

In Central London, more than a fifth of office space — a record 2.5 million sq ft — was leased to flexible workspace operators in 2017, a 190% increase compared with the previous year.

Flexible workplace operators now occupy around 10.7 million sq ft of space across Central London, or just over 4% of all office stock.

This makes London “the global leader for flexible workplaces”, far ahead of New York in second place: “Since 2012, flexible workplace leasing has represented an average of 2.9% of the market in Manhattan, compared to 10.6% in London.”

WeWork is London’s largest single occupier

Against this activity, WeWork has become the largest single occupier of office space in Central London.

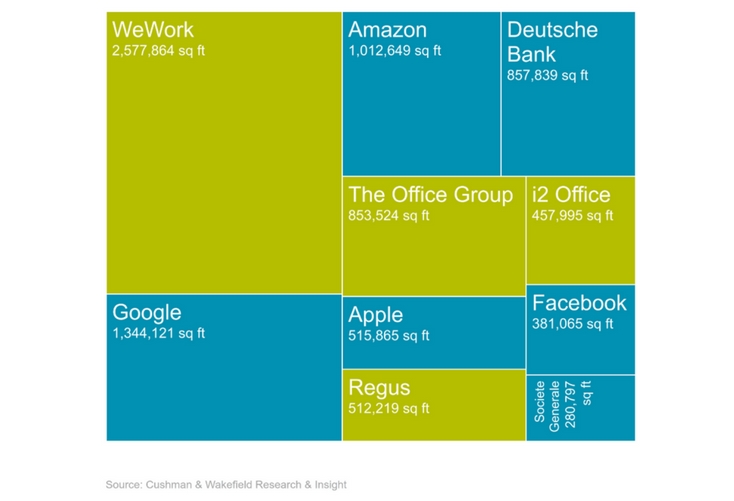

Over the past 5 years, WeWork has leased over 2.5 million sq ft of space in the capital, more than any other company — including Google (1.3m sq ft), Amazon (1m sq ft) and Deutsche Bank (857,839 sq ft). WeWork now has the largest volume of space commitments behind only the Government.

Within the top 10 largest occupiers of space, WeWork is joined by three other flexible workspace operators including The Office Group, IWG and i2 Office.

However, the report also claims that around 1.5 million sq ft of flexible workspace in London has ceased to operate over the last 10 years.

One such example is Rainmaking Loft, which closed its doors last year after WeWork moved into the same building.

Such is its expansion that WeWork now has the largest volume of office space commitments in London, second only to the UK Government.

Another example is British Land’s termination of IWG’s lease at Euston Road, in order to enable British Land to expand its own flexible workspace brand, Storey.

Putting the figures into perspective

- Over 5 years between 2007-2011, a total of 1.2 million sq ft was leased for flexible space in London.

- The next five-year period from 2012-2016 saw the flexible workplace sector lease a total of 4.5 million sq ft across 210 transactions.

- In 2017 alone, a total of 2.5 million sq ft was taken-up by flexible space.

The trend is expected to continue, with Cushman & Wakefield predicting “increasing demand for coworking space” over the next year, particularly from larger businesses as Brexit looms closer.

Plus, new lease accounting standards (IFRS 16) are expected to push up demand for flexible space.

A new ‘space race’ leads to alternative ideas

However, this is placing increasing pressure on supply. As the ‘space race’ intensifies, Cushman & Wakefield expect operators to seek alternative accommodation for coworking and flexible spaces.

“While offices have been the traditional source of space, pubs, hotels and libraries are increasingly of interest to flexible space providers,” said Elaine Rossall, Head of UK Offices Research & Insight at Cushman & Wakefield.

Flexible workspaces are now a vitally important part of the UK economy, and an increasingly familiar presence in our cities.

“Any brick-and-mortar business that is vacant for a period during the day could be utilised for flexible working, and the availability of vacant retail units could see coworking become a fixture of high streets across the UK.”

Indeed, London isn’t the only city enjoying the flexible workspace boom.

The report finds that around two thirds of the UK flexible workspace market is outside London, and many of the UK’s largest cities “saw significant growth” in coworking — helped largely by WeWork and Spaces — which increased from 2% of all city centre lettings in 2016 to 7.5% of take-up in 2017.

Flexible workspace recognised as “vitally important”

Rossall added:

“Flexible workspaces are now a vitally important part of the UK economy, and an increasingly familiar presence in our cities.”

Looking ahead, Rossall commented:

“One of the key issues will be growing pressure on the supply of suitable coworking space and whether landowners and developers can keep up with demand. Nevertheless, we expect flexible workspaces will account for at least 10% of the total market across the UK within the next 10 years.”