- Last year, coworking grew by 62% across Australia

- Demand for flexible space continues to soar, with some operators running waiting lists

- Although competition is intensifying from global companies entering the market, operators view the “positive attention” as an opportunity

Flexible workspace is booming in the Asia Pacific region. Yet it’s not just major cities in China, Hong Kong and Singapore that are attracting international brands and multi-million dollar investment.

Australia, which already has a well-established flexible workspace market, is gearing up for a new wave of activity as demand soars and coworking operators push into new locations. In particular, Sydney and Melbourne are enjoying the lion’s share of attention as global and local companies alike race to snap up available space.

In August 2017, Knight Frank delved into the Australia coworking market and revealed:

- The number of coworking spaces in Australia grew by 297% between 2013-2017, to 309

- In 2017 alone, coworking grew by 62% across Australia, totalling more than 50 new coworking spaces

- The industry occupies 193,190 sq m across 6 cities, equivalent to 0.6% of office stock, suggesting that the flexible market is still in its infancy

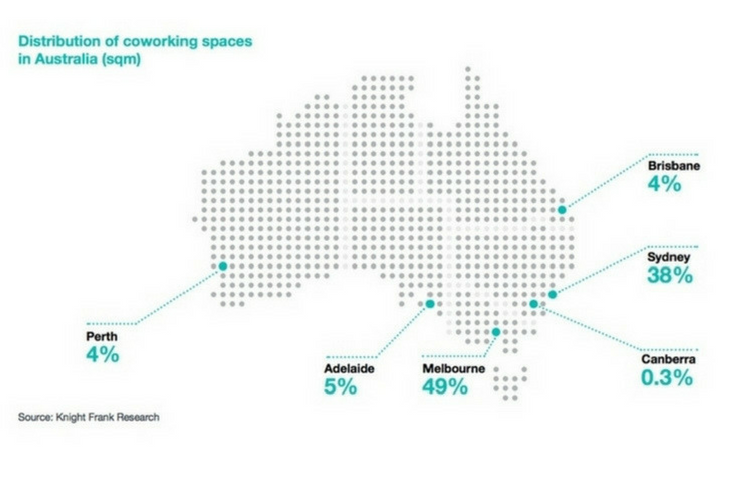

- Across Australia, Melbourne has the largest concentration of coworking spaces with 49%. This is followed by Sydney with 38%, Adelaide (5%), Perth and Brisbane (4% each), and Canberra (0.3%)

According to Knight Frank, “While growth from this sector has been rapid, it has come from an extremely low base, and in terms of growth, Australia’s coworking industry is still in its infancy.”

Putting that into perspective, Central London has three times the number of coworking spaces than all of Australia.

However, the market is catching up.

Hub Australia has just announced two new sites in Melbourne within weeks of each other, bringing its total Melbourne footprint to more than 10,000 sqm (107,600 sq ft). Shanghai-based naked Hub bought a 70% stake in Australian coworking brand Gravity and plans to further expand the group’s portfolio. WeWork currently has 5 locations across Melbourne and Sydney and is set to open its next space in Brisbane. Hong Kong workspace brand, Campfire, will launch new spaces in Australia this year. And there’s plenty more activity besides.

Soaring demand and waiting lists

“Demand for coworking in Melbourne continues to increase, in particular from growing businesses and established medium sized businesses and corporates,” says Brad Krauskopf, CEO and Founder of Hub Australia.

“We have a waiting list at our current Hub Southern Cross site and it’s largely due to companies wanting flexibility in what is predominantly a landlord’s market.”

According to Krauskopf, Hub Australia has experienced “huge growth over the past year or two” but more importantly, their members’ businesses have also grown, and companies are increasingly choosing coworking spaces such as Hub Australia “for the ability to attract and retain staff, rather than just being drawn to the flexibility.”

Krauskopf is not alone in this trend. He notes “an increase in operators entering the market” in response to high demand, which still exceeds supply — but the attention from local and global competitors is not necessarily a threat.

“The arrival of WeWork to Australia has brought a lot of positive attention to the coworking market from businesses of all sizes,” Krauskopf says. “At Hub Australia, we have a strong team in place and a quality product so we’ve been able to capture a lot of the new market interested in coworking.”

39-year old business centre brand expanding in Sydney

While coworking remains the buzzword of choice, demand for flexible, design-led space is not just about a desire to work in collaborative environments. Indeed, the serviced office sector preceded the coworking movement by some decades, and most flexible space operators now operate a hybrid offering of coworking and serviced space.

One of those operators is Ultimate Office Solutions, which was founded in 1979 and currently operates four serviced office locations across Sydney, with a fifth launching this July.

“The demand in Sydney for all manner of flexible workspaces is as strong as I can remember,” says Brian Challen, CEO of Ultimate Office Solutions (UOS).

“Our 4 hybrid centres in Sydney are averaging over 90% occupancy with strong internal demand from existing clients and members wishing to expand.”

UOS has a waiting list for some locations and according to Challen, this trend looks set to continue. “We see no let-up in demand for flexible workspaces in the foreseeable future, particularly in Sydney CBD as there is limited space availability.”

“Competition keeps us on our toes”

As for competition from operators such as WeWork, Challen sees it as an opportunity rather than a threat: “Competition in our industry is good for us all. It keeps us on our toes with innovative new offerings and evolving workspace environments to satisfy client demands.”

Testament to continued demand, UOS is set to open its fifth Sydney workspace in the coming months. The new space will feature 2000 sq m of coworking and serviced space in Pitt Street, situated between 3 other UOS centres in the surrounding CBD.

Alongside UOS, Hub Australia is also seeking to expand its footprint in Sydney with the launch of a second location, Hub Hyde Park, this month.

Krauskopf notes that the coworking market in Sydney benefits from the tightening of the traditional office market combined with rising lease prices, which is contributing to greater demand for coworking.

Commenting on the current shape of coworking in both Sydney and Melbourne, he added: “The local sector is still evolving and there is huge potential for growth in the next few years.

“I think we will see consolidation and a lot of spaces are going to need to invest, because you simply won’t be able to compete if you don’t have a great facility that complements the community you are cultivating.”