- Smaller Space-as-a-Service operators are starting to impact the CRE space

- Their flexible business models bring benefits to both landlords and tenants

- Space-as-a-Service provider Bold expects “tremendous growth” from coworking corporates

The CRE industry is morphing into a service-based industry where the traditional notions of public and private space are now eroding.

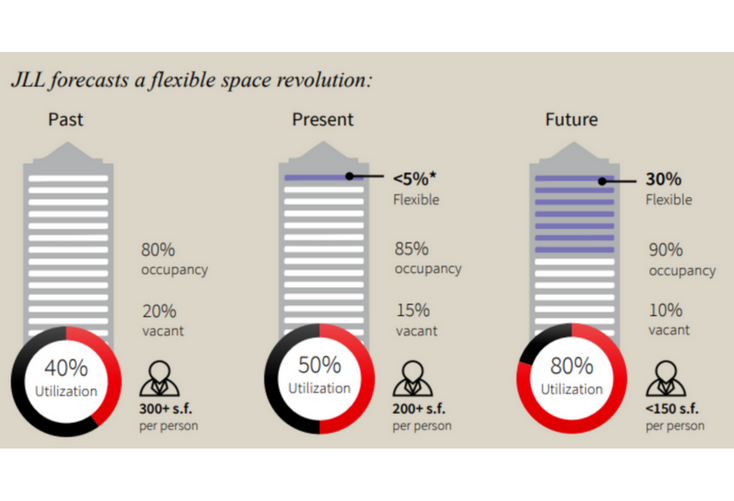

As a result, flexible workspaces will be in high demand. Research reveals that, by 2030, 30% of corporate office footprints will consist of flexible space and, in 2022, there will be more than 30,000 coworking spaces.

So, landlords need to change their mindset and embrace flexible spaces, or risk losing their best tenants to the competition. One concept that’s gathering pace to address these changes and challenges is the Space-as-a-Service model. Here, landlords can rent out their square footage for flexible working initiatives.

One of the most prevalent examples of this in the real estate industry is the behemoth coworking operator, WeWork. However, such operators usually require a sizable space (of the order of 25,000 to 40,000 square foot) and provide homogeneous designs and solutions.

If you have a smaller footprint or want to do something a little different with your space, you may assume you have to go it alone and open your own flexible workspace business. And that can be a risky strategy – only 40% of dedicated coworking spaces are profitable.

Introducing a Different Space-as-a-Service Approach

This is where the small-scale Space-as-a-Service providers step in to address this gap in the market. For example, Space-as-a-Service operator Bold transforms spaces that are between 5,000 and 15,000 square foot.

Caleb Parker, co-founder and CEO of Bold, said: “More and more landlords want to incorporate flexible amenities into their spaces. But this can be tricky to achieve. Landlords don’t necessarily have the expertise to successfully set up and run such a space.”

“Tenants also demand flexible workspaces – but often on an ad hoc and external basis. For example, a successful business may often swap its underused meetings rooms for desks as its headcount grows. This makes sense to make the best use of the space. However, when there is an occasional need for a meeting room, they don’t have one anymore.”

A shared Space-as-a-Service model addresses all these concerns and, for landlords, you don’t have to give up tens of thousands of square footage to set up your flexible space. You could simply convert one floor or small area in your office into a flexible workspace.

Parker added: “Consequently, tenants can use the flexible workspace as and when they need to, without giving up any of their own office space. What’s more, those tenants that are liable to request the use of a shared flexible workspace are often the ones whose businesses are succeeding and, as such, landlords want to attract and retain such clients.”

“Landlords can benefit from higher rents and occupancy rates by using a Space-as-a-Service platform.”

Getting more for less? This almost sounds too good to be true. But it does make sense. Let’s explain using figures from JLL’s 2017 report Bracing for the flexible space revolution.

In the past, office spaces were divided into desk space, offices, meeting spaces and other amenities (such as a lunch room, server room etc). However, private spaces such as meeting rooms and offices would often sit empty.

The Space-as-a-Service model makes the most of the space available: the landlord can add a flexspace amenity to a building where, for example, a tenant could rent a meeting room or hot desk on an ad hoc basis.

“This is the best of both worlds for the tenant and the landlord. Tenants reduce their footprint but still get access to a flexible workspace. The landlord will attract and retain their best tenants by providing them with a model where they can accommodate variable demand and shrink their fixed costs,” Parker added.

Space-as-a-Service provider eOffice offers a range of flexible workspace options. Its CEO and founder, Pier Paolo Mucelli, said: “We offer space on a flexible basis and this space is usually up to around 10,000 sq ft to bring in the community factor that’s often lacking in big spaces. Smaller spaces mean you can control the environment better, which is important for businesses that want to take a more personalised approach.”

Space-as-a-Service Gives Corporates an Easy Entry Point into Flexible Working

While flexible working has seen massive growth in recent times, coworking for enterprises is just starting to take off. While some businesses are opening their own version of coworking spaces to foster innovation, the Space-as-a-Service model could be extended to provide these corporations with in-house flexible amenities.

“We’re seeing increasing demand from growing and established organisations to create a fully managed, creative and flexible workspace. I expect to see tremendous growth in this area where Bold’s Space-as-a-Service platform provides a turnkey solution to these businesses,” Parker said.

It’s an attractive option from a financial perspective too, as coworking corporations benefit from average savings of 25% compared to a traditional office lease, according to a recent report by Colliers International.

You Get Something Different and Designed for Your Tenants

Partnering with a Space-as-a-Service provider gives landlords greater choice over the design of their space.

For example, at Bold, their interior design team decorates each space in one of their Bold themes. These themes are designed specifically to inspire creativity and collaboration. Each theme incorporates lots of colours and patterns and they work with landlords to shape the feel and identity of each space within these themes.

A Bold footprint incorporates a mix of private spaces, a drop-in area for flexible working and a cafe serving strong Bold coffee. The size of your footprint can scale up and down to match your asset – the choice is yours.

And this inherent choice is what sets apart Space-as-a-Service providers apart from the WeWorks of this world.

It’s the start of a David versus Goliath battle and, ultimately, the tailored and flexible approach of small-scale operators could chip away at the dominance of the major, incumbent Space-as-a-Service players.

However, Mucelli believes there is room for all in the flexible workspace world. He explained: “Approximately, 95% of office space in London is occupied by tenants with a traditional lease, with 4 to 5% for flexible workspaces, but the proportion of flexible offices will increase. We are working with companies who used to sign 10-15 year leases, and now they can only predict how many desks or space they will need six or 12 months into the future.”

“As a result, there will be many different operators with different approaches and styles going forward and this choice is important. It’s like comparing Starbucks to a specialised coffee chain. Both businesses appeal to different people for different reasons – it depends on the level of experience you want.”

“Whereas tenants used to sign leases for up to 10-15 years, landlords are more willing to experiment and end users are more aware that they do not need to rent a traditional leased office in the long term.”

“I think there will be a number of large international operators in the future, but there will be plenty of space for smaller, niche or specialised operators and a number of flexible workspace business models serving all types of businesses,” Mucelli concluded.

The times are certainly changing and the Space-as-a-Service model does bring the inherent flexibility that landlords and tenants demand. While there can be no doubt that Space-as-a-Service will break into the mainstream in the CRE industry, it will be interesting to see exactly how this model adapts with the changing world of work.