- A recent CBRE report looks at whether tenancy of flexible space operators impacts property values.

- It found that 40% of buildings that include flexible workspace achieved values greater than the average for office buildings in their market.

- However, that’s not the full story. Too much coworking space in a building is associated with more risk, yet too little means that it doesn’t influence value either way.

The short answer is: yes, but it depends on how much of a building’s space is allocated to coworking.

A recent CBRE report looks at whether tenancy of flexible space operators impacts property values. To do so, CBRE analyzed 31 transactions of office buildings that had at least 10% coworking occupancy and then compared it to 104 transactions of office buildings with no flexible workspace occupancy.

Coworking today accounts for over 25 million square feet across 30 of the top US office markets and it has caught the attention of property owners and REITs that are interested in increasing the value of their properties by allocating a certain amount of square footage in their buildings to coworking space.

Suggested reading: The Top 5 Ways CRE Is Crossing into the Coworking Industry

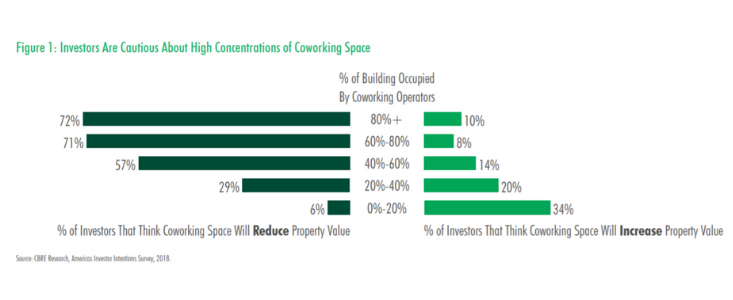

Still, even though big names like Blackstone Group, Tishman Speyer, and British Land have significantly invested in the industry, many investors are still unsure of the impact coworking can have in their properties and the value that flexibility brings to their office assets. According to the CBRE report, “the higher the proportion of coworking space in a building, the worse for long-term capital values.”

Generally speaking, “flexible space has the potential to increase and diversify a building’s income stream because these tenants theoretically command higher rental rates and improve effective occupancy relative to a traditional office lease.”

On the other hand, “flex tenants don’t always have strong covenants; therefore, those buildings with high flex concentrations are susceptible to more risk than those where flex space is just a small portion of the total rent roll.”

And although CBRE’s analysis found that nearly 40% of buildings that include flexible workspace achieved values greater than the average for office buildings in their market, the jury nonetheless remains out. This is due to the fact that the transactions CBRE analyzed were completed in high-growth markets where cap rates are lower than the national average.

Building Class vs Market

Interestingly enough, CBRE found that there was “a pronounced divergence in cap rate performance when the flex transactions were split by class of building.” This suggests that Class B and C buildings could increase their value more than Class A buildings by having coworking space. This could be a result of the fact that coworking operators and the improvements they make to a building lead“lower-classified flex buildings to perform as if they were Class A assets.”

“More than 75% of Class A flex transactions had cap rates that were on par with their peers, but none outperformed. In contrast, 57% of Class B flex transactions had a higher cap rate than their peers, while 21% had lower cap rates.”

Concentration of Coworking Space Directly Affects Property Value

CBRE also found that the percentage of the building occupied by flexible workspace also affects a property’s value. “Class A assets with lower shares of coworking tend to have better investment performance than Class B assets. However, appropriately positioned Class B assets with high shares of coworking have the potential to positively differentiate an asset from comparable properties.”

Too much square footage allocated to coworking can scare off investors as it is associated with more risk. Too little of it means that it doesn’t influence value either way.

Caption: Investors remain cautious about office buildings with a high concentration of coworking space.

Below 40% of a building’s square footage seems to be the right amount of space that should be allocated to flexible space. Anything over that reduces the value of a property from an investor perspective.

CBRE estimates that by 2028, flexible workspaces will represent as much as 10% of Class A buildings.