Hand selected flexible workspace news from the most reliable sources to keep you ahead of the pack. We find all the latest news, so you don’t have to. Morning and afternoon updates. Stay in the know.

Here’s what you need to know today:

- Google Extends Remote Working Policy Through Summer 2021 NEW

- Flexible Offices Could Be Faced With New Opportunities. NEW

- Companies Rethink Their Workspace Strategy NEW

- Keeping Employees Safe In The Workplace

- Office Leasing Continues To Dip In The U.S.

- Property Fund Manager To Repurchase Coworking Firm

Google Extends Remote Working Policy Through Summer 2021

Google has revealed that it will extend its remote working policy through to June 30, 2021 for the majority of the company’s 200,000 employees due to the ongoing pandemic.

Sundar Pichai, CEO of Google, said this choice is to aid working parents with children’s school schedules as many will be attending classes virtually in the coming school year.

“To give employees the ability to plan ahead, we are extending our global voluntary work from home option through June 30, 2021 for roles that don’t need to be in the office,” said Pichai in an email to employees. “I hope this will offer the flexibility you need to balance work with taking care of yourselves and your loved ones over the next 12 months.”

Google is one of many technology companies that have readily embraced remote working arrangements for the time being. For instance, Amazon extended its work-from-home policy through January 2021 and Facebook told workers they can work from home until the end of the year. Mark Zuckerberg, CEO of Facebook, also said he anticipates that half of Facebook’s workforce will work remotely by 2030. Twitter CEO Jack Dorsey also announced that employees that are not required to be in a physical office can work from home permanently.

Flexible Offices Could Be Faced With New Opportunities

During Commercial Observer’s Power Briefing, Breather CEO Bryan Murphy discussed the potential opportunities that could be opening up for the flexible workspace industry despite a slowdown due to the pandemic.

According to Murphy, it is during times of crisis when trends of disruption occur. For instance, the Great Recession ushered in the wide adoption of software as a service. A similar trend will likely happen in a post-pandemic society, as companies look to flexible offices to cut down on financial risk, avoid long-term leases and embrace flexibility.

“It’s about managing financial risk,” said Murphy. “There’s a huge capital outlay, and there’s a tremendous amount of uncertainty short term because of COVID and the economy, and longer term because of this work-from-home trend. [So companies are] trying to figure out, what’s our policy going to be? How much space do we need? What does that space need to look like? It will be very different.”

Although working remotely has been found to offer numerous benefits, Murphy added that collaboration and engagement take a hit. That is why returning to offices is necessary for some, but not without a major facelift.

Murphy says there are three pillars in creating a truly safe office: curated design that accommodates distancing, FF&E (furnitures, fixtures and equipment) such as sanitation stations and barriers between desks, and reevaluating operations to meet CDC guidelines.

Companies Rethink Their Workspace Strategy

Bill Seretta, president of nonprofit Sustainability Lab and owner of food business incubator Fork Food Lab, had big expansion plans for his company prior to the pandemic. Now, they’re essentially starting over.

In order to meet guidelines like physical distancing, Seretta is now looking at a 15,000 to 20,000 square foot facility to buy or build. The space could then be utilized to accommodate Fork Food Lab members who are undergoing big transitions during these uncertain times.

The need for more flexible office space has been the focus of many real estate discussions as companies look to keep their workspaces safe and healthy for employees.

“We’re starting to see some companies look at reconfiguring or redesigning their offices in a way that provides more space and flexibility for their employees,” said Drew Sigfridson, Boulos Co., managing director and broker who is helping Seretta in his search for a new workspace. “If they had certain requirements that they thought they needed six months ago, many of those clients are adjusting those requirements now.”

For some companies, those changes include looking into offices outside of metropolitan areas and in the suburbs to allow employees to work closer to home. This also allows for more spacious facilities that meet the new necessary needs of the workplace.

Those who are looking into new office space will want flexibility, without the popular open-office layout that has taken over workspaces over the past few years. Now, private offices and barriers between desks will be readily embraced once more.

Keeping Employees Safe In The Workplace

The pandemic has altered the way we interact in our everyday lives, particularly in the workplace. Now that companies are starting to bring employees back into the office, they are forced to reevaluate how they operate, and what the best methods will be to keep them safe.

First, it is important to understand what workers actually want. Just because you can bring them back into the workplace, doesn’t necessarily mean you should. With surveys finding that the majority of the U.S. workforce is concerned about exposure to the virus in the workplace, requesting they come back into the office could be adding additional stress.

Equipping your company with safety protocols and resources is one way to instill trust in your employees. Things such as temperature screenings, increased sanitation practices and distanced workstations are a few easy ways to create a work environment that values the health of workers.

Flexibility will also be key in helping employees balance their work and personal lives. Finding new ways to get work done will be essential moving forward. This is particularly important for working parents, whose children may be attending school virtually in the coming fall.

Along with flexibility will be the need to embrace agility. Evaluating your talent and ensuring that they are able to upskill easily will keep the workforce resilient, engaged, connected with one another and satisfied in their positions.

Office Leasing Continues To Dip In The U.S.

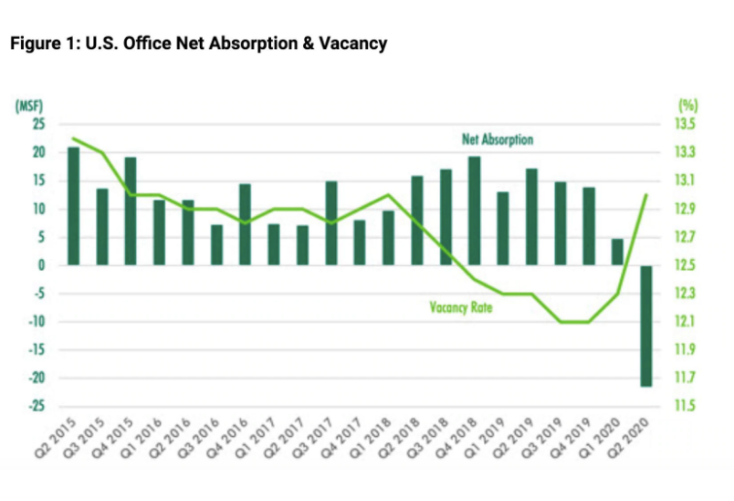

According to a new report from CBRE, office leasing has fallen by 21.5 million square feet during the second quarter of 2020, marking the biggest fall since the Great Recession.

“Leasing activity in the second quarter fell by 44% year-over-year, increasing the national office vacancy rate by 70 basis points to 13%,” said analysts with CBRE. “COVID-19′s full impact on the U.S. office market was evident in second-quarter 2020 with the largest quarterly drop in demand since 2001.”

The slowdown in office space demand has led to a surplus of sublease space as companies look to put extra office space on the market.

According to the report, cities such as Austin, Boston, Chicago and San Francisco have seen a particularly large uptick in sublease space.

In the Dallas-Fort Worth area, office leasing decreased by nearly 2 million square feet of space as the pandemic continues to result in job losses and an economic dip.

Property Fund Manager To Repurchase Coworking Firm

BlackWall, a property fund manager, has backed away from its own coworking brand and instead will look to purchase an operation that is struggling throughout the pandemic.

Earlier this year, BlackWall had completed the demerger of coworking operator WOTSO, with shares in the firm being distributed to BlackWall shareholders.

BlackWall had hopes to move forward with a public listing in the midst of the coworking boom last year, but the pandemic brought these dreams to a halt. Now, BlackWall says it will purchase back WOTSO.

“It is expected the acquisition will secure WOTSO’s growth trajectory without the need to raise additional capital in an uncertain market,” said Jessie Glew and Tim Brown, BlackWall’s joint managing directors. “We do not expect the transaction to diminish BlackWall’s standing as a property investment trust as WOTSO is expected to represent less than 10 percent of the expanded group’s assets.”

Once completed, the property fund manager will have gross assets of about $400 million.