- It’s the first time a collaborative space owner and a property consultant have co-authored a publication.

- JLL and WeWork’s report finds that the key drivers of demand for coworking in India are cost, infrastructure, and networking opportunities.

- The potential market size for the coworking segment across India currently stands in the range of 12-16 million people.

For more on the coworking market in India, click here.

The coworking market in India has seen dramatic growth this year (2017), attracting significant investment and large operators to the region.

JLL and WeWork took on the project to study the market, its potential, and its drivers. The results were published in the research report “Future of Work: The Coworking Revolution”. The research was led by Ramesh Nair, CEO & Country Head of JLL India, and Juggy Marwaha, the former India Lead at WeWork, and is the first co-authored publication between a collaborative space owner and a property consultant.

We are witnessing a truly disruptive business model in the form of coworking. With millennials driving the workforce and the growing need to build communities, we have a chance to shape the future of work. The coworking revolution will truly define the future of work in the commercial office segment. This is where tomorrow’s new office space opportunity lies. — Ramesh Nair CEO & Country Head, JLL India

Coworking isn’t a new concept; however “what is exciting about it is the tremendous growth it has seen around the globe in the past several years.” The case of coworking in India is unlike that of many other countries. India is today the third largest startup hub in the world, with a total employee base of one million people.

Additionally, India has a huge freelance workforce, “in excess of 15 million professionals, and growing at a fast pace.”

According to the research, “the numbers are expected to more than double by 2020”, posing a great growth opportunity for the workspace-as-a-service industry in the country. Findings predict a “potential demand for more than 3.5 – 4 million seats” in alternative and shared workspaces.

As the sharing economy gains traction, India is fast-becoming a hub for shared workspaces, with the key drivers of coworking spaces in India being: cost, infrastructure, and networking opportunities.

“In India’s top cities of Delhi National Capital Region (NCR), Mumbai, Bangalore, and Pune, a coworking space is likely to lead to cost savings in the range of 20-25% when compared with leasing a traditional office space.

“Mumbai MMR offers the best opportunity for creating coworking offices, targeted at firms seeking activity-based spaces for focused talent groups. Not to be left behind, large corporate firms too, are bucking the trend in the search for alternative workplaces to nurture top talent.”

Yet, the coworking market in India is still in its early stages — although things are expected to change in the foreseeable future.

Shared workspace operations in India are dominated by local players that tend to maintain a healthy 85+% occupancy rate, with branded coworking spaces nearing 100%. This domestic domination, however, is in its last stages. WeWork opened its first location in India this year and the report predicts that “more players from the US are also set to enter India’s coworking marketplace.”

Worth noting is that there’s plenty of room in India both for local and international players to succeed, though experts do expect consolidation to happen eventually.

“The potential market size for the coworking segment across India currently stands in the range of 12-16 million.

“With office rental costs continuing to rise across India’s business districts, the total space leased by coworking operators in the top cities could potentially stand at ~7–9 million sq. ft. by 2020.”

Looking ahead to 2020, “Mumbai and Bangalore offer by far the best opportunity for creating coworking spaces targeted at corporate firms seeking activity-based office space for focussed talent groups.”

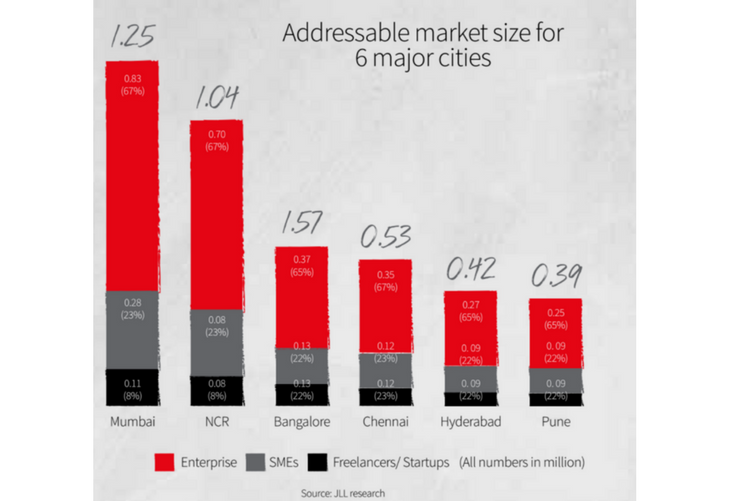

Of this potential national market, just across Delhi NCR, Mumbai, Bangalore, Chennai, Hyderabad, and Pune, there exists a potential of 5 million.

There exist, however, aspects that could limit this potential growth: consolidation and exclusivity agreements between landlord and tenants. The latter of these two poses a greater threat, as it significantly limits the range of quality options and locations where coworking providers can be housed.

Still, the opportunity is greater than the threat, and coworking in India is a lucrative business.

“The break-even period for operators has been approximately five months of launching — bearing evidence to the pent up potential across India’s top cities.”