- Robert Kropp dives into the challenges and opportunities faced by the flexible workspace industry over the past year.

- In the final part of an 8-part series, Robert shares key learnings and insights from the Instant Group and Convene.

- Both organizations explain how they adapted to the events of 2020 and transitioned their business models, and how they see the industry shaping up in the future.

This is the final part of an 8-part series focusing on the evolution of the flexible workspace industry. In this series, I have been diving into key topics of learning related to the pivots, opportunities and changes that industry leaders, owners, operators, advisors, landlords, and consultants have experienced over the past year.

If you missed the other seven articles in the series, check them out:

- Part 1 with GOOD SPACE, CoworkLand, VR Coworking powered by weXelwirken, SaltLabs

- Part 2 with OneCowork, Venture X, Creative Works

- Part 3 with Impact Hub, Work.Life, Spacemade

- Part 4 with Use.Space, Venture X, Cobalance Café

- Part 5 with Hera Hub, Mindspace

- Part 6 with The Melting Pot, HATCHERY

- Part 7 with BE.Spoke, The Executive Centre

In this article, I share discussions I have had with The Instant Group and Convene.

TLDR Highlights:

- The Unknown Became More Predictable

- Increasing Agility within Portfolios

- Landlords & Operators Recognizing Opportunities for Growth

- Third Spaces

- WFH vs the Return to the Office

- Meetings & Events go Virtual

- 3 Tiers of Hybrid Events

- Digital First is Key to Delivering Hybrid Models

- 2021 – 2022 Trends

Here is what we learned and what’s next:

The Instant Group (England based, operating globally)

It was great to catch up with Lucy Watts, Executive Director, Operator & Landlord Solutions at The Instant Group.

The Instant Group offers not only advisory and delivery of commercial real estate solutions for organizations globally but also operates the listing platform, Instant Offices.

Lucy said that in the beginning of 2020 like many others, they initially saw demand drop completely on their listing platform while operators and landlords faced other challenges — namely, customers were told to work from home and could no longer use workspaces in many markets, despite many flexible workspaces remaining open.

In the first lockdown, everything was unknown and focused on the short-term needs of customers, and how operators could support them through this challenging period.

During this time, she also said that corporate occupiers, landlords, and investors began asking questions about what data and insights they could gain from past experiences. This analysis not only looked at the recovery following the 2008 financial crisis but also the demand recovery in the APAC region post-lockdowns.

Key Learning: Through a greater analysis and understanding of our experiences, we are able to make better predictions for what a return to ‘normality’ might look like in a specific area.

Key Learning: By the time of the 2nd and 3rd lockdowns in some areas (late 2020), there was much less debate on what to do. Demand on the listing service had also gradually returned. Lucy said, “we knew how to make workspaces safe and secure, clients knew how to work with the operator / landlord, and discussions were more (focused on the) long term.”

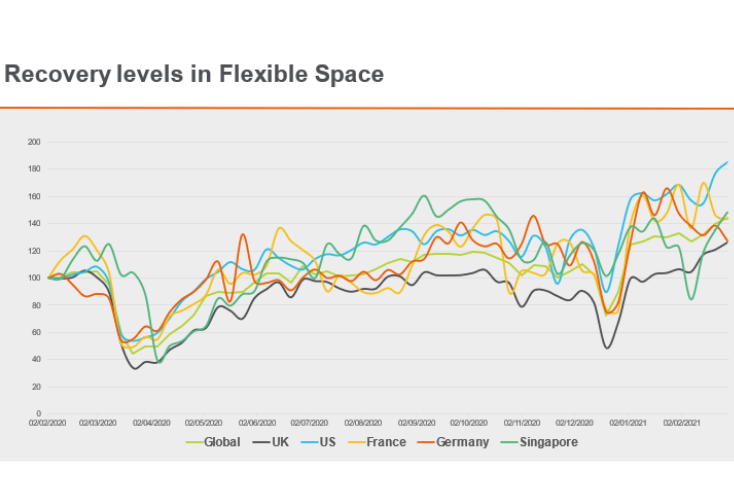

Here was an interesting snapshot Lucy shared of what early-stage demand for flexible workspace looked like across a few markets during 2020. How did this compare to what you were experiencing?

From a real estate and flexible workspace perspective, she continued to say that the conversation had also shifted to “increasing agility within portfolios”. This included a diversified portfolio for a diversified workforce in order to “help provide choice for employees and enable businesses to use workspace in a way that optimizes performance and output.”

However, Lucy did state that some decisions just can’t be made right now. “There are some clients thinking about how they utilize space. If they have too much space, how can they handle that? … There is a lot of activity on solving those challenges.”

Key Learning: By February 2021, new “lockdowns aren’t impacting transactions like in early 2020.” Organizations are “still signing contracts and making decisions.”

This is critical as generally the sentiment is improving for many organizations and markets.

Key Learning: For landlords and operators, Lucy also said they are noticing those who are in a strong financial position, are also “not really focused on the immediate challenges like the first lockdown. It is “more about expansion and recognizing the opportunity for growth in the flex market”.

“Single city providers are moving to secondary markets or expanding internationally.” The key shift is that more providers are focused on expansion through the management agreement model now. Landlords without a flex offering are deciding how to build a solution and shift their assets “to have that mix usage” balance between “flex requirements and traditional leases.”

Future: The discussion around third spaces also became more and more common over 2020 and 2021. Whether it was hotels, shopping malls, or high streets, stakeholders are increasingly asking questions about how to better utilize these spaces. For example, how are these properties going to monetize space, evolve amenity offerings, offer coworking / flex space, and generally use space in more dynamic ways.

Key Learning: Organizations will continue to drive the supply changes in real estate markets as they are “thinking about how to support work from anywhere and the desire of employees post pandemic.”

“There is a huge level of interest coming from clients who need to mobilize global workforce into flex solutions.” Ultimately Lucy says that supply will be the challenge if more workers want to work closer to home. These decisions need to be based on data of where workers need or want to work. At the same time, amenities will need to continue to expand and improve in workspaces: “if you are leaving your house it needs to be convenient and worth going to.”

Future: She also said that sustainability is continuing to grow as a topic of discussion and demand for consulting. Organizations expressing interest in sustainability want to see “strategies to make buildings (and workplace environments more) sustainable”.

Future: In many ways, working from home was successful, however, Lucy also says that based on their surveying, the sentiment over time has increasingly become more negative for some.

“People are more capable of working remotely” and “there isn’t a need to take everyone 5 days back in the office but (what will happen is) still unclear.” She said that “employees have expressed a desire to get back to the office but perhaps to have a bit more choice. Businesses are focused on creating the right kind of workspace environment to allow for collaboration and spending time with colleagues.”

Overall there is much optimism for the future now, although Lucy believes that “we aren’t out of the challenging period yet” as we continue to roll out vaccines and some markets enter new lockdowns.

Future: Throughout 2021 and beyond, she expects existing operators to expand and new players to enter the market with “more landlords partnering or delivering on flex solutions.” At the same time, Lucy expects core markets such as London, Manchester, Bristol, Birmingham, and other global markets to return.

Convene (United States based, operating globally)

I also had the pleasure to chat with Ryan Simonetti, the CEO and co-founder of Convene.

Convene provides meeting and event solutions, flexible workspace in 6 markets, and a hospitality offering for offices and buildings.

Impacts from the pandemic began in late February 2020 for Convene, when a large event with attendees coming from Asia was canceled. Ryan said they knew “it was going to be a problem.”

What followed was a focus on being proactive by shutting locations and working with customers, the board, and landlord partners “to get through it”. The key was to “#1, Accept Reality. #2 Plan for the Worst.”

As we have heard from many organizations, the next 5 – 6 months were extremely challenging and focused on cutting costs and serving the changing needs of their stakeholders (landlords, customers, and businesses).

However, Ryan said that although Covid was challenging, it led to plenty of opportunities for the short and long term.

One such opportunity that we dove quite deep into was a result of all of their meeting and event business needing to go virtual immediately. The question that needed to be answered was “what if we built a virtual venue to recreate the Convene experience digitally.”

What came out of this was Virtual Meetings, a virtual conferencing platform aligned with human support (ie. an event producer, tech team, production team, etc) for recreating an event, conference, or meeting virtually.

For much of 2020, they refocused much of their business toward growing this portion of the business which is expected to grow 15+ fold from 2020 – 2021.

Ryan believes much of the success isn’t just in the ability to deliver on virtual because as he put it, “the future of work used to be flexible. Now it is hybrid.” This includes events. Attendees, speakers, and even sponsors will no longer have to be in person but can choose to be.

Key Learning: 3 Tiers of Hybrid Events

- A lot of organizations will opt initially for 1.0 hybrid. This includes onsite experiences and a live stream to a virtual audience, a branded event site, online chat, networking with virtual users, etc.

- “Run a physical event and a virtual event at the same time while using tech to find the intersection point between the virtual audience and experience.”

- True hybrid – Immersive with no difference between virtual and physical. This is complex and likely too costly to solve today. “A lot needs to happen to get there.”

Although this messaging is primarily focused on events, hybrid will also be a larger part of many organizations’ work and workplace strategies coming out of the pandemic. At the same time, we will need to continue solving problems and challenges coming out of these hybrid experiences.

Since organizations are going from virtual to hybrid now and in the future, they have already started asking the question, “how do you integrate those experiences in a thoughtful way.”

Ryan says that “digital first is a core strategy.” Whether it is work or meetings, organizations need to focus on digital transformation and the digital experience to deliver on hybrid.

Future: For 2021 – 2022, Ryan also expects the following trends to continue to expand for many organizations:

- Flight to quality – Class A buildings, renovated, new infrastructure, clean air, contactless buildings and spaces

- Flight to brand – When you talk about health and safety, brand will be critical. Organizations need to be able to trust that the building owners and service providers will look out for their employees.

- Digitization of entire workspace

- A distributed workforce = distributed spaces

In addition to their event market growing, they are also expecting to expand in core markets in the US and UK over the next 2 years.

At the same time, Ryan says they are looking to “unlock value with strategic partnerships and M&A”. This included a recently announced partnership with Marriot to help deliver hybrid meetings to customers.

We have heard it many times. The blending of workspace and hospitality is definitely a trend to keep looking out for.

I am looking forward to seeing what else is ahead for the industry moving forward!

Looking Ahead

Thank you to The Instant Group and Convene for partaking in my series on key learnings from the flexible workspace industry during 2020 and beyond.

Although these organizations are quite different in mission, size, model, and location, it was interesting to see what they have experienced, learned, done similarly and different, along with what they expect from the future during a time of such significant change.

As more people and organizations than ever are looking at coworking, flex space, space as a service, and other flexible workspace options as actual options, it is important for us to be agile, learn, and adapt to these changes.

If you would like to chat about your workspace or organization’s experience this past year and outlook for the future, feel free to contact me directly.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert