Look around OT and you’ll find plenty of discussions relating to changing workplace attitudes and a rocketing growth in mobile working trends. It’s all to do with a greater acceptance of flexible working that’s helping to change the way businesses of all sizes use workspace. Work is no longer a place – it’s what we do.

But amid all this talk of cultural change, where are the cold hard facts? Can we measure whether or not flexible working is actually happening – and whether it’s really working?

One way to measure this change is to monitor the movement of the flexible workspace industry itself. While many large-scale surveys point to corporate models to identify workplace trends, much of the real and lasting change is happening at grass roots level – in SMEs, start-ups and ambitious Gen Y business leaders. These companies are nimble, able to embrace change in flexible working practices and to recognise that with today’s technology, work can be accomplished without walls.

Serviced office brokerage firm, Instant, has revealed a set of facts and figures spanning the last two years of the serviced office industry (July 2011 – July 2013). The data was released as part of a presentation by Instant’s Patty Vozzo at the Global Workspace Association conference in Atlanta, GA, in September.

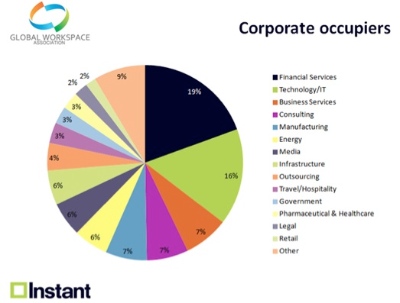

This data, which shows impressive growth in all key global markets within the two-year time frame, also highlights the type of corporate industries that are adopting flexible workspace. This shows that, while SMEs and smaller companies have always traditionally favoured the industry, corporates are increasingly turning to serviced offices as a flexible and more cost-effective way to conduct business and explore expansion opportunities.

Regional growth

Instant’s data revealed that the following regions have all experienced development in the flexible workspace market:

- Asia-Pacific grew by 26.7%

- EMEA (Europe, Middle East and Africa) increased by 25.1%

- UK grew by 13.3%

- The Americas increased by 13%

In the last year (July 2012 – July 2013) the number of working serviced office locations increased by 9.1% globally, with a 3.6% rise in North America alone.

As far as the number of people per contract, Instant reports that there has been a yearly increase in all regions except for Canada between July 2012 and July 2013.

Corporates to watch

Many operators of flexible workspace reported an upswing in the number of corporate clients during the downturn, as serviced office space provided a low-commitment and cost-effective solution at a time when regional economies were filled with uncertainty. It also enabled corporates to explore new locations or set up satellite offices without the commitment-heavy responsibility of a traditional office lease.

According to Instant, Financial Services and IT are the corporate markets to watch. Financial Services represented 19% of the occupiers of serviced offices, while Technology & IT made up 16%. The markets of Business Services, Consulting and Manufacturers accounted for 7% each.

Cost comparison

Instant also supplied a cost comparison across the global serviced office space market. Taking an average price per desk in each of the key locations below, dated July 2013, the results provide some interesting – and surprising – insights into the established and emerging markets.

In the conventional lease market Hong Kong regularly tops the bill as the most expensive office space location in the world. In flexible

workspace however, Hong Kong pales against the financial clout of Paris and Tokyo:

-

- Paris: $1490 / £920

- Tokyo: $1324 / £820

- Hong Kong: $1147 / £710

- Singapore: $1122 / £695

- Beijing: $1090 / £675

- London: $956 / £592

- Sydney: $875 / £542

- Shanghai: $722 / £447

- Madrid: $675 / £418

- Berlin: $620 / £384

Average price per desk, July 2013, Instant

These differences can be attributed to various factors, such as type and style of space, availability, length of lease, maintenance rates, supply and demand, and so on. While Instant’s data provides a top-level account that does not take these comparables into account, it nonetheless offers an interesting insight into the state of the global market.

Above all, these stats offer a positive picture of the global serviced office sector and shows that the market is indeed growing. Instant acknowledges that the serviced office sector continues to grow in established markets such as the US and the UK, and claims that emerging markets are predicted to undergo some of the fastest growth in the next decade.

This in turn adds further evidence that flexible working itself is gaining traction, and offers a measure by which we can track the seismic cultural working shift that is happening right under our feet. Positive stuff? We think so! Now is a good time to be in the flexible working game – and we look forward to continue tracking the many exciting developments within our industry.