Starting December, 2015 the market value of Regus Plc (now called the International Workplace Group Plc) has seen roughly a 25% drop.

This article is part of our “we’re all about community” series.

This isn’t the first time Regus has experienced rough times. Back in the early 2000s, Regus sold 58% of its UK stake to Rex 2002 Limited as an attempt to raise money during difficult financial times, partially caused by the burst of the dot-com bubble. Not long after that, Regus US was forced to file for Chapter 11 bankruptcy.

Regus eventually overcame its financial difficulties and in 2006, the company was able to re-acquire control of its UK branch. Since then Regus has focused on global expansion, partnerships, and acquisitions; and done an amazing job of it.

And although the long-established flexible workspace company has been heavily investing in its growth and expansion over the last three years, its stock value has steadily declined since December, 2015.

On December 2, 2015 Regus PLC’s price was at 354. Since then, their value has been steadily decreasing, reaching a particularly low point on November 23, 2016; with a price value of 225.

Why this is unusual and shocking

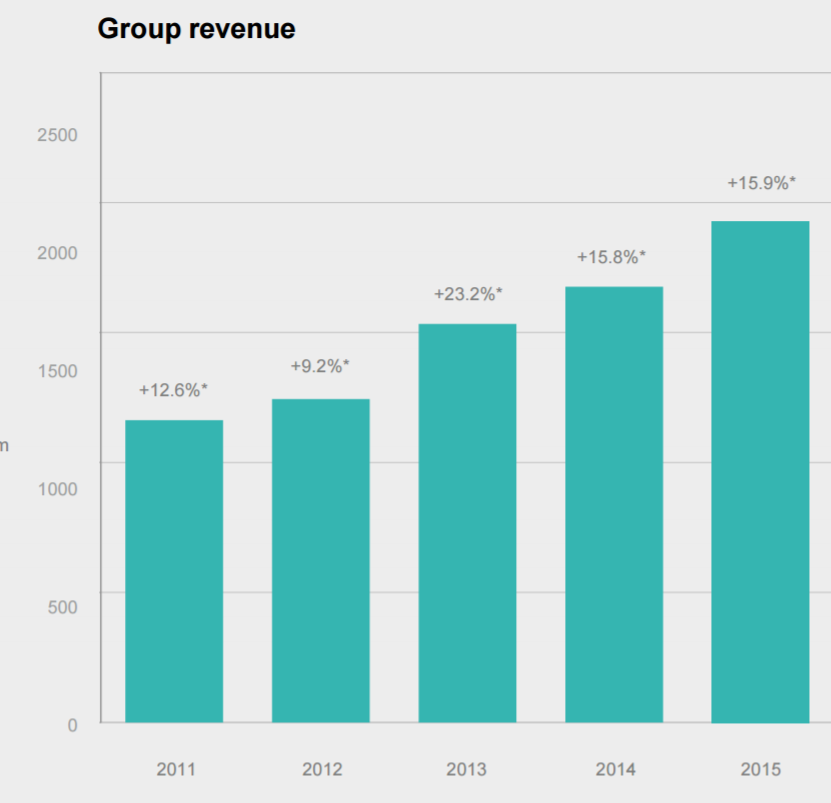

Regus has expanded its global footprint significantly over the last 3 years, both through organic growth and acquisitions.

In 2013 Regus had a total of 1,929 locations

In 2014 they brought that number up to 2,269 locations

In 2015 they closed the year with 2,768 locations

By the end of the first half of 2016 (June 30), Regus had a total of 2,845 locations

More locations doesn’t necessarily mean a successful and profitable business, and Regus has incurred plenty of costs in order to power their expansion.

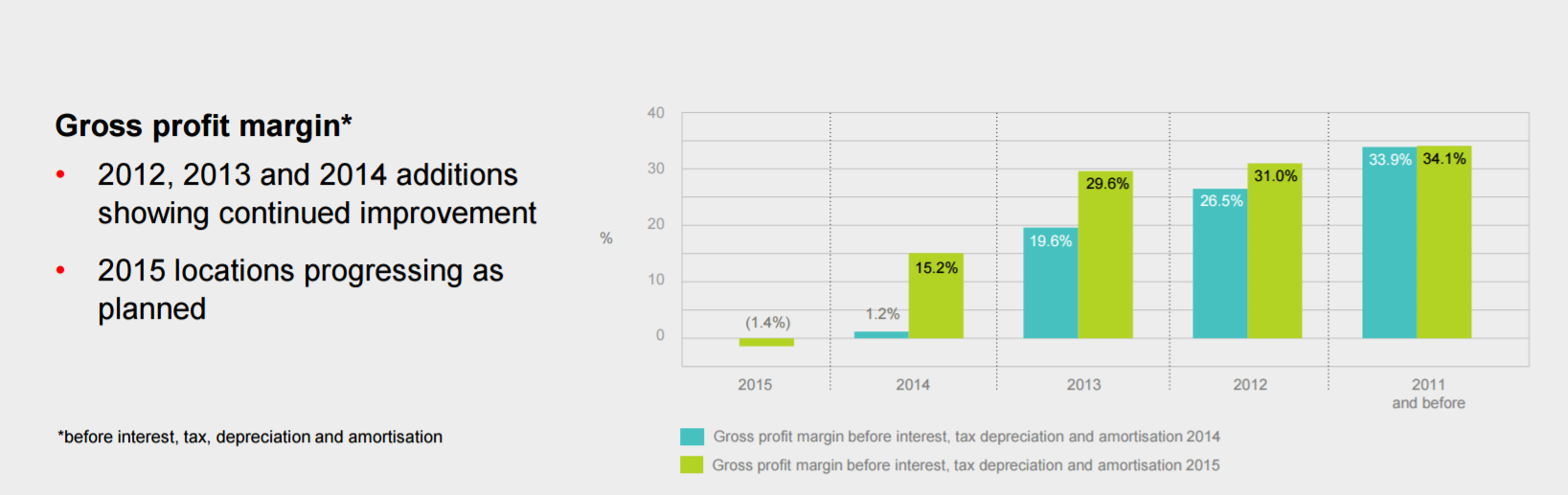

Though on the surface it looks like Regus is battling to keep its balance sheet on the positive side, this is far from the truth.

December, 2016 CapitalCube said that Regus’ year on year change in revenues and earnings are better than the median among its peer group. They also said that their return on assets currently and over the past five years suggest that its relatively high operating returns are sustainable.

If you take a look at Regus’ annual reports, it’s clear that the flexible workspace company is definitely seeing strong return on investment. The catch is that the return on investment isn’t immediate; it’s Regus’ mature centers–those that have been operating for three years or more–that are bringing in the money.

Since 2011, their group revenue has steadily increased.

Images taken from Regus’ annual reports, available here.

The question remains unanswered though. Why is Regus’ stock value decreasing when group revenue is rising and many key indicators are pointing to a profitable business?

Having dominated the traditional business center market for so long, are they in danger of losing touch with new generations? Are investors skeptical regarding how much more they can grow in a competitive industry? Are investors looking for more immediate ROI?

Or, is Regus failing to deliver in an industry that is becoming increasingly focused on community-led spaces?

“The company’s median gross margin and relatively high pre-tax margins suggest non-differentiated product portfolio but with tight cost control relative to peers.” – CapitalCube

A little over a year ago, right after Regus’ stock value peaked, the company transitioned to a Community Manager structure after years of operating under a Client Service Representative and General Manager model.

Whether the shift was successful or not, we can’t say–but like Susan Smith said in an article last year, “it’s not enough to change a title. The average Community Manager dedicates at least half of his or her day as a curator, getting to know the personal and professional lives of each member, and constructing spaces in which coworkers and staff can collaborate together and prosper.”

When Regus transitioned to Community Managers, it also designated ‘Area Managers’ that would be responsible of at least 3 to 5 locations. In her article, Smith argued that “slashing staff adds more work, increases stress, and reduces the amount of quality time available to spend with your clients and community.”

Smith seems to have hit the nail in the head.

Recent posts from a review website created by ex-Regus customers give the impression that the flexible workspace company still has a lot to learn about hospitality and community (two important elements of the workspace-as-a-service industry that more contemporary operators have gotten right. More on this later.)

In an industry where the focus should always be on service and on the user-experience, Regus might be failing. The issue, it seems, is that Regus is much too focused on the business part of their company (cutting costs, tight management, etc) than on the service, or community, aspect. In the past, when business centers were the most common type of flexible workspace option and when workers wanted full privacy and to be left alone, this approach worked.

However, the rise of coworking and community driven workspaces has put Regus’ offering on the wrong side of the playing field. And they are aware of this. In Spring, 2015 Regus acquired the Dutch coworking company, Spaces; additionally, they are also the parent company of Kora and OpenOffice. Nonetheless, not many associate the name Regus, let alone The International Workplace Group, with these other brands or with the term coworking itself.

On the other hand, we have flexible workspace providers that have have received incredible amounts of financing to grow their coworking, community, and hospitality brands.

WeWork, Industrious, Serendipity Labs, and Mindspace are only a few of the many operators that have been graced with funding from various investors. Unlike Regus, these companies have focused highly on the value proposition of community, of hospitality, and of service.

Clearly, there is interest from investors in the flexible workspace industry, otherwise WeWork wouldn’t be valued at a whopping $16billion and Industrious and Mindspace wouldn’t have closed successful funding rounds in the last year. Unfortunately for Regus, investors don’t seem as interested in their value proposition, or so we gather from their stock value decline.

CapitalCube’s theory is that while “the revenues in recent years have grown faster than the peer median, the market gives the stock a P/E ratio that is around peer median suggesting that the market has some questions about the company’s long-term strategy.”

The question is, will community (or lack of thereof) kill Regus? Or will Regus, as they have done so many times before, fight back and adapt yet again to the demands of a new generational workforce? With a new name and a proven history of survival and re-invention, we’re betting on the later; but only time will tell.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert