- Will vaccination rates impact return-to-office rates in key cities? Data from The Instant Group suggests so.

- Two cities in Instant’s analysis have the lowest rates of vaccination – and the lowest demand for flexible space.

- This link is evident in the US, the UK and EMEA. In Europe, flexible workspace demand is most hampered in Poland, which reports only a 41% vaccination rate.

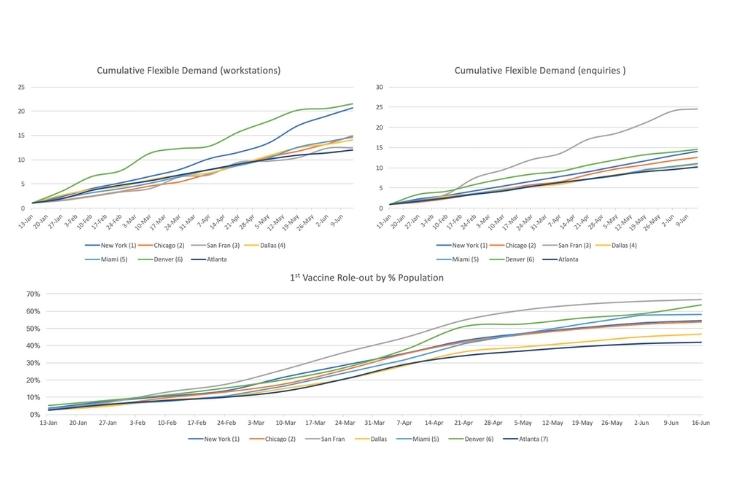

Is there a link between vaccination rates and flexible workspace demand? To answer this question, The Instant Group reviewed flexible office demand by workstation and inquiries in six major U.S. cities and compared the demand with vaccination roll out data.

What did the data say?

After looking at data from its listing platform for New York City, Miami, Chicago, Denver, San Francisco, Atlanta, and Dallas, The Instant Group found that there appears to be a general link between demand for flexible workspaces and vaccination levels.

“Our preliminary data suggests that vaccinations matter,” Joe Brady, CEO Americas, said during an interview with Allwork.Space. Whether it was public perception or consumer confidence remains to be determined, but the important takeaway is that there seems to be a relationship there.

“Good examples of this are Dallas and Atlanta,” Brady added. “Dallas and Atlanta have the lowest rates of vaccination—at 47% and 41% respectively; these two cities have the lowest demand for flexible space according to our data. On the flip side, Denver and San Francisco—which have vaccination rates of 65% and 67% respectively—have the highest flexible space demand.”

The workspace innovation company also found similar data in the UK and EMEA. The cities with the highest vaccination rates are also experiencing the highest demand for flexible space there, Brady added. In Europe, flexible workspace demand is most hampered in Poland, which reports only a 41% vaccination rate.

Interestingly, Brady mentioned that cities with higher vaccination rates are experiencing increased demand from enterprise clients, except for San Francisco. The Instant Group is not seeing large requirements for flexible space in the San Francisco market, although it is seeing small flexible space requirements.

Then again, San Francisco reports a lower back-to-office percentage than the national average, Brady commented. According to data from Castle Systems, only 20% of the San Francisco workforce was back in the office by mid-June; the average US return to office is 32%.

Brady argues that what this says is that “people want to get out of the house, but they don’t want to go back to their long commutes.”

Another reason why return to office rates in San Francisco are lower than the US average could be that technology firms are more progressive in terms of work from anywhere, meaning that these companies are not yet asking employees to go back to the office, even part-time.

Moving forward Brady argues that there is a fundamental acknowledgment that knowledge workers want agency, autonomy, and optionality. “Employees don’t want to be told where they need to go and punch in their card.” Organizations that understand this and allow workers to choose where and how they work will experience purposeful presence in the office from employees, as opposed to passive attendance if they’re forced to be there.