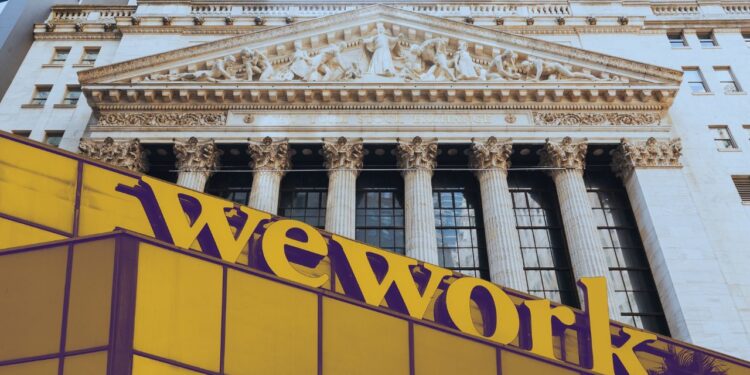

The New York Stock Exchange (NYSE) has declared that WeWork Inc.’s warrants, which grant holders the right to obtain a single share of Class A common stock, will no longer be transacted on the exchange due to “unusually low” rates.

Following WeWork joining the 95% Club — that is to say, companies whose shares have lost more than 95% of their value since listing on the stock exchange — it is not surprising that warrants to buy those shares at a price that was fixed in relation to the share price at the date of listing, have become almost worthless.

We say almost worthless because warrants and options rarely have no value at all as they contain “time value,” that is to say the hope value that a stock might somehow regain its former value before the warrant expiry date, perhaps by becoming a meme stock such as Bed, Bath & Beyond.

In the case of WeWork, that would be a forlorn hope, and the warrants are to all practical purposes worthless, so the NYSE has delisted them.