The flexible workspace industry continues to grow, according to new data from CoworkingCafe’s Coworking Industry Q4 2024 report. The national coworking inventory reached 7,695 spaces by the end of 2024, signifying a 2% increase from the previous quarter.

This continuing upward trend, while modest, highlights the growing demand for flexible workspace solutions as businesses and professionals adapt to new working models.

“The coworking market is evolving rapidly as hybrid and remote work continue to change the traditional office landscape,” the report states. The analysis details trends in the 25 largest U.S. markets, covering metrics such as space numbers, square footage, and growth rates.

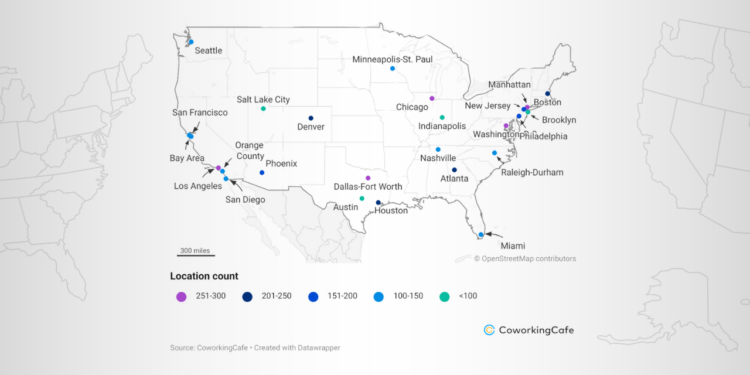

Los Angeles and Dallas-Fort Worth remain the leading markets with 292 and 286 spaces, respectively. Washington, D.C., and Chicago followed with significant additions, while Manhattan saw a slight dip.

Salt Lake City emerged as a standout market, recording the highest quarter-over-quarter growth at 8%. Other notable increases were observed in Phoenix (4%) and Raleigh-Durham (6%). Conversely, Brooklyn experienced the sharpest decline, dropping 8% to 1.79 million square feet.

The national median starting prices for various coworking solutions, including virtual offices and dedicated desks, showcased mixed trends. However, the overall space allocations rose by 3%, reaching 136,852,460 square feet.

“San Diego witnessed the most significant expansion in terms of square footage, with a 15% increase,” the report highlights.

Meanwhile, Manhattan remains the largest coworking market by square footage, strengthening its position as a strategic hub.

Leading coworking operators also continued to dominate the market. Regus, Industrious, WeWork, Spaces, and HQ collectively managed 1,720 locations.

Industrious was the leader in growth among these operators, adding 13% more locations in the top 25 markets.

The report provides an optimistic outlook for sustained growth and innovation, fueled by the increasing need for adaptable office solutions.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert