Germany’s fractious coalition government is set on Friday to pass a bill to raise pensions by around 185 billion euros over the next 15 years and let retirement-aged workers work tax free.

Economists say the pension rises will make the system’s already shaky finances even less sustainable, as ever fewer workers are expected to support ever more pensioners in an aging population.

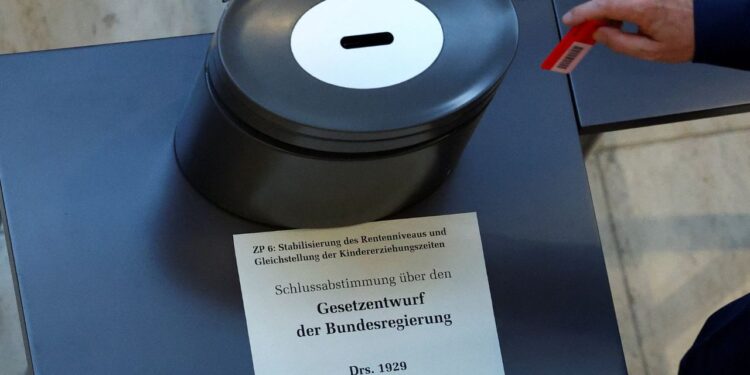

The bill was part of the coalition agreement of German Chancellor Friedrich Merz’s conservatives and the centre-left Social Democrats (SPD), though it was at risk of not passing due to a revolt by younger conservative lawmakers.

The government has promised a broader reform in 2026, with input from expert commissions.

Here are the key points of the 2025 pension package:

Average Pension to Stay Higher For Longer

The average state pension in Germany, now worth 48% of the average wage, will remain at that level until 2031, before falling slightly to 46.3% by 2039.

Without intervention, the value of the average pension relative to wages had been set to fall sooner and more quickly, to 44.9% of the average wage by 2040.

According to new figures in the pension insurance report, this change will cost a total of 122 billion euros by 2039.

It partly reverses a 2005 reform designed to limit the pension level if the number of pensioners grows faster than contributors.

Germany is facing a particularly rapid rise in the old-age dependency ratio, increasing pressure on its pay-as-you-go social insurance system.

While in 1992 there were 2.7 contributors for every pensioner, there are now fewer than two. By 2050, there will be just 1.3 contributors per pensioner.

Increase in Parents’ Pensions

The so-called “mother’s pension”, which credits parents for time spent raising children, will also be extended for parents whose children were born before 1992.

Parents will be offered credit for up to three years of childcare for children regardless of the year they were born. Previously, parents of children born before 1992 could claim only six months of credit.

Around 10 million parents, mainly women, are to benefit from this extension, which will cost 62.7 billion euros by 2039.

Incentives for Post-Retirement Work

In a bid to keep workers in the workforce for longer, the bill will allow those who work beyond the retirement age of 67 to earn up to 2,000 euros per month tax free.

In 2030, Germany’s working population will probably have decreased by 6.3 million people from 2010, according to an interior ministry demography report. This will push down gross domestic product (GDP) per person as there will be fewer workers for each retiree.

The change is to take effect at the beginning of 2026 and is expected to cost the state 890 million euros per year in lost tax revenues from 2026 to 2030, according to the draft law.

($1 = 0.8583 euros)

(Reporting by Maria MartinezAdditional reporting by Holger HansenEditing by Peter Graff)