India has quickly become one of the world’s most developed flexible office markets, and is now on track to reach 100 million square feet of flex workspace by 2026, according to Cushman & Wakefield’s Global Trends in Flexible Office 2025 report. The country now surpasses traditional leaders like the U.K., France, and the U.S. in scale, maturity, and innovation within the sector.

Scoring a perfect 100 on Cushman & Wakefield’s maturity index, India leads global peers by offering a rare blend of extensive flexible inventory, diverse operators, and innovative leasing agreements. These factors have reshaped how companies approach workspace strategies in the region.

India’s flexible workspace market currently holds nearly 80 million square feet of inventory across its top eight cities, with Bengaluru commanding 30% of that space. The sector is expected to grow to 85 million square feet by the end of 2025 and surpass 100 million square feet by the following year.

Demand for flexible offices has surged dramatically, increasing nearly sixfold since 2020. In 2024, flexible spaces accounted for 15% of all new office leases, signaling mainstream acceptance.

Notably, international enterprises drove 72% of flexible seat absorption in 2024, while startups made up the remaining 28%. The rise of global capability centers and multinational firms expanding into India further fuels this demand.

Operator activity has intensified significantly, with flexible workspace providers leasing 33.5 million square feet between 2022 and 2024, tripling annual take-up over five years. The managed office or enterprise model now dominates post-pandemic demand, representing 70 to 80% of leases, overtaking traditional coworking models.

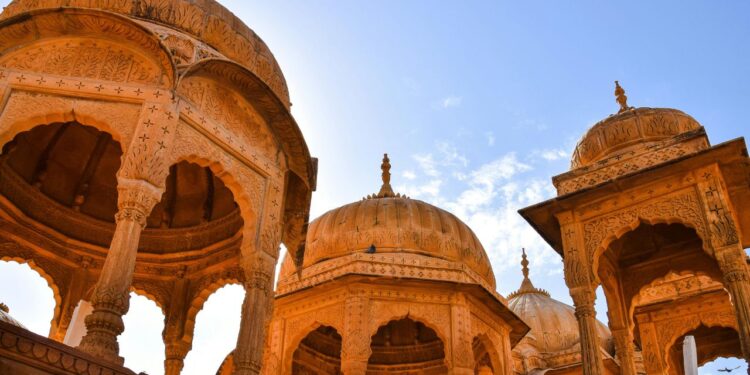

While the top metros — Bengaluru, Delhi-NCR, Pune, and Hyderabad — remain the core of India’s flexible office market, Tier II cities such as Chandigarh, Jaipur, Kochi, and Visakhapatnam are increasingly attracting occupiers seeking new talent pools and cost efficiencies.

Institutional confidence in India’s flexible office sector is growing. Four operators have already gone public, and more initial public offerings are expected. This trend points to greater transparency, stronger governance, and increased investor interest.

The next few years are likely to see market consolidation, with leading players strengthening their positions and specialized regional operators focusing on niche demands.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert