Last week, we reported how WeWork seems to be using questionable tactics to try and convince members from other workspaces to switch over to them. And although we are indeed concerned about their potentially unethical approach to marketing, we are also highly concerned that what they are offering could potentially depreciate the flexible workspace market.

Like we wrote in last week’s article, we received information from several workspace providers that WeWork was targeting their members, offering 50% off to those individuals willing to switch over and move into WeWork locations.

50% off of any lease is no small amount — and by offering such a discount, the coworking giant is likely to force other operators to drop their prices. In the long-run, this isn’t sustainable for anyone involved — except maybe WeWork if they continue to raise as much funds as they have in the past.

Then again, if business isn’t doing so great and WeWork can’t fill up all of its locations as they predicted, we are curious to see whether or not investors will be as keen to invest in the ‘tech’ company as they have done in the past.

But, let’s not deviate from the topic at hand. WeWork is claiming to offer 50% off to those who sign a 2 year lease, and this could seriously depreciate the value of the market.

Our question is: if WeWork is as innovative and successful as they claim to be, why do they need to cannibalize clients from other operators at all? Studies have shown there’s plenty of flexible workspace demand on a global scale, so they — with their funding and location numbers — should be growing our industry and not trying to feed off it.

Carrie Gates from Barrister Executive Suites gave a warning to those considering switching, saying “buyer beware, if it (the 50% off deal) seems too good to be true… that is often the case.”

Bait-And-Switch

So, is WeWork really depreciating the market? Or is their 50% discount only a marketing strategy aimed at getting people to bite?

We think…it’s the latter.

A mystery shopper followed-up on WeWork’s offer and here’s what we learned: WeWork seems to be using what appears to be the old bait-and-switch approach to get clients.

Basically, bait-and-switch is a marketing strategy that tricks individuals into buying something other than the advertised item/service. Usually the tactic includes offering a low-priced item and then ‘encouraging’ (tricking) people into buying a higher-priced one.

Below is a summary of what the mystery shopper reported.

Following the sales pitch given outside another operator’s location, the shopper scheduled a tour. When the shopper went on the tour, the on-site sales person seemed unsure of how the deal offered worked, but promised to email the details.

The WeWork sales person sent a follow-up email, attaching a proposal. However, the proposal sent on the email made no mention of the 50% off deal, and it was also different from what was quoted during the tour.

During the tour, the shopper was quoted a total of US$1,200.00 with an effective rate of US$600.00 after the free rent. The proposal sent via email quoted US$1,400.00.

When the shopper asked, again, about the terms of the 50% discount and how it would work, the response received was that “the free rent deal would be discussed after you become a member”.

Basically, they were telling people they would get 50% off, to be amortized over the length of the lease; however, they would first need to sign a contract that made no mention of the deal and in no way guaranteed that they would indeed receive the discount.

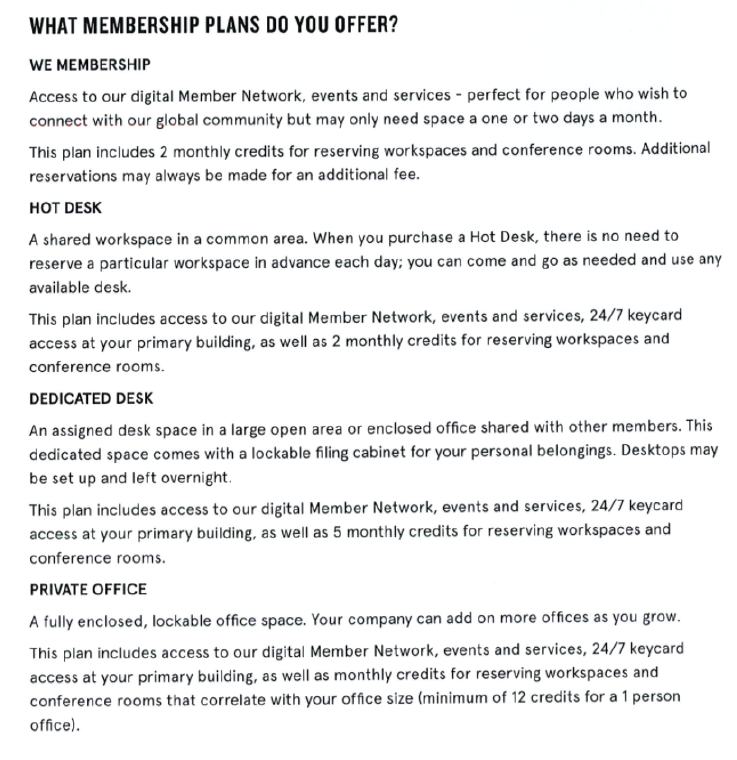

But that’s not all. The contract also showed that most of WeWork’s amenities come at an extra cost. Depending on the membership, clients get a set number of ‘credits’ that can be used in exchange for printing or meeting room usage. Credits, however, cannot be used for phone answering or mail handling services; these services need to be hired at additional cost.

As you can see, the lower-cost memberships only offer 2 credits per month — meaning that members could either reserve one day of workspace or one meeting room per month.

Since there is no standard, there is no way of knowing how many credits a member might need to host 2 or 3 meetings a month. Additionally, if members run out of credits (which is highly likely), they can purchase additional ones.

The images below display how much each credit costs in different countries.

[huge_it_slider id=”5″]

Clearly, the deal isn’t as simple as receiving 50% off the agreed rate. Members would still need to pay for a setup fee, a retainer fee, and any other additional services that might be required.

WeWork isn’t then necessarily operating at a loss, and members are potentially paying more than they originally signed up for. In our opinion, this is a Classic bait-and-switch.

Yet, this doesn’t mean WeWork isn’t going to extreme lengths (and paying a high price) to acquire more members. With various locations significantly vacant, WeWork is also trying to incentivize brokers into sending members their way.

As many of you probably know, the industry standard on broker commission is 10%. WeWork, however is offering up to 20% commission, as the following images prove.

[huge_it_slider id=”6″]

Granted, there is no written rule that states that broker commissions can’t go beyond 10%. And, to a certain degree, it ends up being cheaper to pay brokers the extra commission to fill up the space quickly, rather than having the space sit empty for months and still having to foot those bills.

In any case, WeWork has grown exponentially in a short period of time. And while their original projections painted a bright future, it seems that the coworking giant is having a hard time filling its centers and attracting clients; this has led them to marketing tactics that are questionable and could harm the industry’s reputation.

Our conclusion? WeWork doesn’t seem to be able to fill up their centers pro forma in a competitive, open, and growing market.