- As more companies embrace hybrid work arrangements, it’s become increasingly clear that flexible workspaces will play a key role in the future of work.

- A recent survey from Incendium found that corporate occupiers have become very focused on their ESG agenda as it is now mandated at a board level.

- The above emphasises just how critical it is for flexible workspace operators to get on board with Environmental, Social and Governance (ESG) in order to attract corporate clients.

With hybrid work in full swing and organisations looking to leverage agile assets and services, it is becoming increasingly clear that flexible workspaces will play a critical role in the future of work.

This year’s Flexible Space Association Conference & Exhibition provided the UK sector with an opportunity to reflect and prepare for the opportunities that lie ahead.

Sustainability has risen to the top of the corporate agenda. The conference’s afternoon panel discussion, The challenges of aligning agility within a corporate portfolio whilst achieving environmental, social, and governance ambition, emphasised just how critical it is for operators to get on board with Environmental, Social, and Governance (ESG).

As Sam Pickering, Senior Director at Incendium, points out at the beginning of the discussion, ESG data is currently lacking in the flexible workspace sector, therefore it is often difficult to determine what ‘good’ looks like.

Incendium intends to set up an industry body and partner with volunteers across the sector to “get a handle on it, and quickly”. “Time is of the essence for the environment but also from a business context, in terms of flexible operators’ future success,” he says.

Alongside its parent company, The Instant Group, Incendium asked a group of operators to describe their current ESG priorities and the challenges they face (the full report will be published shortly). Pickering summarised some of the key findings as follows:

1. Over the last 12 months, corporate occupiers have become very focused on their ESG agenda – it’s mandated at a board level, it’s part of their business strategy, and more importantly, reporting has moved up a level.

2. Operators are beginning to take action and momentum around ESG is accelerating.

3. Collaboration between the landlord, flexible workspace operator, occupiers, and clients is going to be essential to drive the ESG adenda forward.

Bold ESG ambitions

PricewaterhouseCoopers (PwC) is a multinational professional services network of firms, operating as partnerships under the PwC brand. The organisation’s sustainability journey took root in 2007 with its Acting on Carbon project, says James Ainsworth, Head of Estate Management, Acquisition & Strategy at PwC.

“It was a sustainability piece looking at our carbon emissions and energy consumption. We went on a ten year journey [2007-2017] and managed to reduce our carbon emissions by 40% and our energy consumption by 60%.”

Ainsworth goes on to reveal that the firm has “pretty much” replaced its estate over the last 12 years, and has significantly reduced the number of physical locations – including “legacy” buildings. All electricity procured within PwC’s estate is now renewable.

Its two London buildings have on-site power generators and cooling/heating power systems that produce around 40% of the energy consumed by the building.

PwC’s Net Zero by 2030 targets are published here.

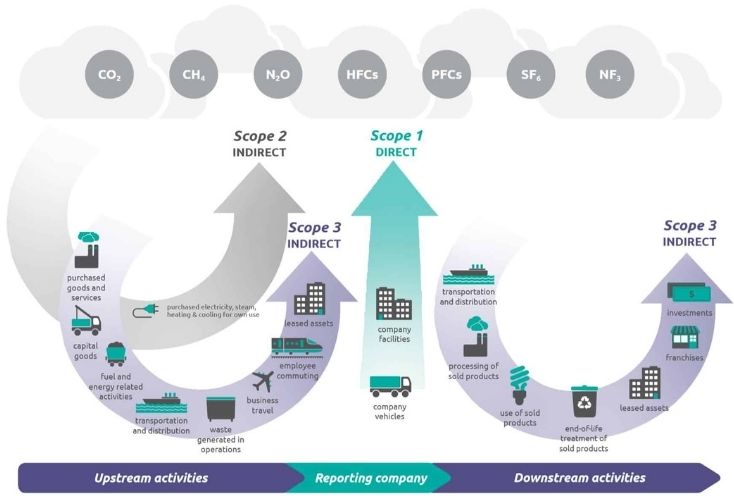

The firm’s next step is to reduce its scope 1 and 2 carbon emissions by 50% by 2030. It is also looking at the business travel element of scope 3, and aims to reduce this by 50%.

“We’re also making big strides into supplier engagement right across the supply chain, whether it’s food, cleaning suppliers, etcetera. We’re asking: how is it coming to us and what are its carbon credentials? We’re aiming for a 67% reduction in scope 3. We’ve got a long way to go but we’ve come a long way too.”

Until now, PwC’s real estate focus has been on procuring more efficient buildings, using BREEAM as a base. 1 Embankment Place achieved the first BREEAM Outstanding accreditation for a refurbishment (completed in 2011); while 7 More London Riverside was the first BREEAM outstanding building in Europe when it was constructed in 2010.

The importance of ESG reporting

Alison Rankin, Global Head of Workplace Services at the asset management firm (and corporate flexible workspace occupier) Schroders, emphasises the importance of ESG reporting, which has recently come to the fore in the corporate world.

“If you look at the annual report of any of your [corporate] clients, there’s now statutory mandatory reporting around scope 1, 2, and 3.

“I want to stress the importance of reporting and the consistency of data; not just the data from our own corporate portfolio – we own buildings and lease buildings – but also from a service point of view. We’re audited on that data so it’s got to be correct.”

Rankin says that data around energy consumption, water, waste can often be difficult to obtain from landlords, and in particular the serviced office market.

Schroders’ current UK real estate model usually involves renting a one to three-person office in a flexible workspace, scaling up to a 12-person office, then moving to a traditional leased workspace when the team begins to scale.

It’s crucial for Schroders to be able to engage with both their serviced and leased office landlords in order to access information around how the buildings are run, because “that’s how we influence change, but it also influences how we’re reporting.”

Schroders shares its sustainability reporting as part of its management accounts reporting on a monthly basis. It looks at profits, losses, and emissions.

“As an organisation, we’ve committed to having 100% renewable energy by 2024 – we’re currently at 67% and we’re aiming for 75% by the end of this year. We’ve got landlords who can’t tell us how they procure their energy, and that impacts our credibility. There’s a huge amount of upskilling that needs to happen.”

“We want to work with our suppliers to understand what they’re doing, because that third party reporting is something we need to be looking at as well. It’s not just about paying the rent any longer, and us taking some space from you.

“We’re asking for much more when we’re looking at our buildings – whether it’s for one month or three years. The quality of the information we need and the relationship we need to build is different now.”

A flexible operator’s perspective

Bruntwood is a flexible workspace and retail space company with locations in Manchester, Liverpool, Leeds, and Birmingham. It was the first commercial property company in the UK to commit to Net Zero by 2030 through the Advancing Net Zero programme.

“2030 is only nine years away, and now the reality is starting to hit home about how we deliver that in the asset plans for each of our buildings,” says the company’s Energy & Environment Director, Bev Taylor.

“Thinking about how to do it while meeting the needs of our customers is probably the most important factor for us. We know that we can’t be successful unless our customers are.”

In the flexible workspace sector, the challenges around reporting are prominent, says Taylor.

“Often, we don’t have the right infrastructure when we’re looking at refurbishing a building or developing a building from scratch, to make sure we’re giving everyone the transparency of data they need. I think it’s time that we started, as customers and landlords, to have open and honest conversations about how we tackle some of these challenges.”

When it comes to workspaces’ ESG credibility, corporate clients are beginning to vote with their feet, James adds. PwC tracks the EUI (Energy Usage Intensity) of all its buildings, taking into account the kilowatt hours by metres squared per year.

“We can benchmark all of our buildings against UK GBC (Green Building Council) targets, see where our average is, and what work we need to do to hit those targets. To meet net zero by 2030, we need to be at 115.

“If we’re looking at a building we might renew in, but it’s got a high EUI, we’ll be coming to the landlord to say: how do we do this? We won’t go into a building unless you can prove its nil-to-landfill. We’re voting with our feet.”

There will inevitably be a financial cost to reaching net zero, Taylor says. To help mitigate this, the “landlord and customer need to come together”.

“We need to be clear as landlords and customers that there will be a cost to net zero, and we need to be open and honest about how we deal with it. We all want the same end goal. It’s time to lay our cards on the table and say realistically, if we want to refurbish our building to meet our carbon and energy intensity targets, this is what needs to happen.”

Taylor notes the importance of establishing rules of engagement at the design stage, “both from a green fit out perspective and from a data transparency perspective”.

Leading the conversation is also key.

“In the flex space there’s a moral responsibility for us, as people who are doing this day in day out, to start sharing knowledge. Operators should be there as an information resource that people can lean on and utilise.

“We need to show up as a knowledge base and a supporting function so that we can help people along their ESG journey.”

From the perspective of corporate occupiers, “just sending us an EPC (Energy Performance Certificate) is not enough,” Rankin admits.

“We want to have a conversation with the on-site facilities manager to find out what’s happening to your waste, how you do your recycling, whether or not you have single-use plastic in your resection area.

“How you run your centre is a reflection on us as well – to our employees and clients entering that space.”