This article is part of the Allwork.Space 2023 Future Of Work Forecast. Click here to read about other trends we expect to see in the new year and how they will impact the future of work.

- ESG mandates are coming, so CRE companies must move it to the top of their agendas.

- In 2023, it’ll be up to CRE leaders to find ways to quantify the productivity gains their real estate offering can produce, and communicate these to prospective tenants effectively.

- CRE companies need to meet the demand of those transitioning to the space-as-a-service model.

PART OF OUR 2023 FUTURE OF WORK FORECAST

It’s a time of significant challenge and change for corporate real estate, as it is for most sectors of the economy. But opportunities also lie ahead for those willing to adapt.

According to JLL’s latest Future of Work survey, which comprises insights from more than 1,000 commercial real estate (CRE) leaders around the world, 2022–2025 will provide a “window of opportunity for organizations to redefine their workplace strategies and to create flexible, tech-enabled, future-proof real estate portfolios.”

To reveal the opportunities that lie ahead for CRE in the short-term, Allwork.Space consulted the research of leading organizations in the sector, and caught up with Tori Shepherd, Manager, Asia Pacific at the International WELL Building Institute, and John Williams, Chief Marketing Officer at Instant.

Here are three key trends on the horizon for CRE in 2023:

1. ESG momentum will increase

Environmental, social and governance (ESG) will be one of the biggest CRE trends in 2023, says Shepherd. Mandates are coming, and CRE organizations must embrace ESG if they want to attract tenants and employees, remain relevant, and stay compliant.

ESG refers to the standards and frameworks that measure an organization’s impact on society and the environment, and it demonstrates how accountable and transparent an organization is in these two areas.

“While ESG has been growing significantly over the past few years, it cannot be ignored in 2023. Globally, the regulatory environment has already shifted or is anticipated to start mandating climate disclosure for public companies,” says Shepherd.

“Organizations are quickly mobilizing to operationalize ESG strategies, which requires CRE companies to establish a cross-functional team to create accountability and drive momentum for ESG performance.

“Commercial tenants will demand real estate that performs highly on ESG metrics, as this impacts their own disclosures. As tenants demand transparent ESG data from building owners/operators, this will put pressure on ESG performance across commercial assets.”

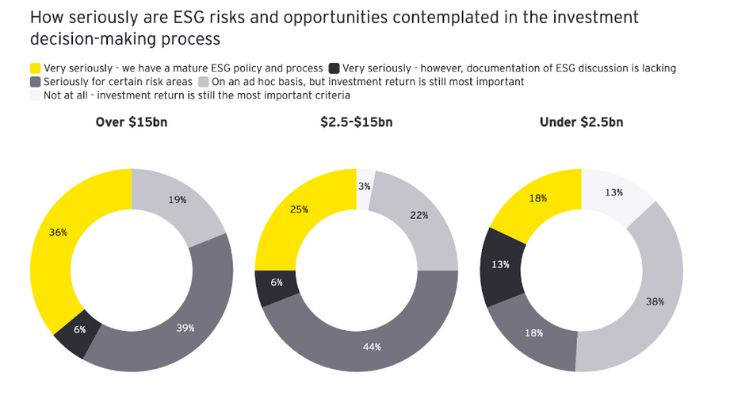

Investors are also sharpening their focus on ESG. According to EY’s 2022 Global Private Equity Survey, 42% of the largest fund managers “seriously” or “very seriously” factor ESG issues into their decision making process.

“In this rapidly changing world, the companies and brands who are winning the future start with protecting and prioritizing their most valuable asset — people,” adds Shepherd.

“Companies with sound ESG strategies, who have incorporated sustainability (human and planetary) into their physical spaces, policies and operational protocols will better weather the storm.”

2. Productivity

Productivity is the value proposition that CRE will — and should — focus on in 2023, says Williams. The U.K. and U.S. (and many other countries’ economies besides) are experiencing the lowest level of productivity in decades.

In an article for the National Institute of Economic and Social Research, Postdoctoral Research Associate Dr. Issam Samiri highlights that “between 1974 and 2008, the U.K.’s productivity grew at an average rate of 2.3% a year, a much higher rate than the growth rate between 2008 and 2020 at around 0.5%.”

“For the office to find its purpose,” says Williams, “it has to not only create the optimal environments to enhance productivity but also take giant strides in measuring its impact in this area. Business leaders don’t want to know about headline rents per sq. ft. or lease lengths, they want to know if their workforce is happy, and getting more done.”

In 2023, it’ll be up to CRE leaders to find ways to quantify the productivity gains their real estate offering can produce, and communicate these to prospective tenants effectively.

“It should be the simplest thing in the world for those selling the office to their customers to show how their businesses will benefit from investing in that space. Instead it simply becomes a discussion around cost with an implied, undefinable benefit. Our sector needs to take quantum leaps in this area to simply stay relevant,” Williams adds.

3. Space-as-a-service

Since the pandemic, companies have been migrating away from more traditional CRE setups to the space-as-a-service model, with an increase in demand for flexible workspaces from both small- and medium-sized enterprises (SMEs) and large companies.

In April 2022, Research Dive published a report predicting the significant growth of the space-as-a-service market over the next few years. Asia-Pacific is expected to be the fastest growing region for this market, with a predicted CAGR growth of 4.6% by 2028.

To continue to attract and retain occupiers in an increasingly competitive landscape, office space landlords and operators need to remain on top of their game.

“Poorly maintained, badly located office space is already falling by the wayside. If workspace is going to mature as a sector then it needs to drop the anachronisms of CRE generations past and start talking in a language that is meaningful to business leaders — and demonstrating that the office is a place to drive productivity not constrain it,” says Williams.

“To do this, takes well-designed, amenity-rich space in locations where teams either want to come together or find time and space to focus. Successful flexible workspace operators ‘get’ this. Commercial real estate is no longer a hill to bury money in, but is another service competing with cafes, restaurants, hotels and gyms.”

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert