Once bustling office towers, a significant amount of commercial real estate is now being repurposed into vibrant urban living spaces, flexible work environments, and student accommodations.

This is clearly a strategic response to evolving market conditions, hybrid work models, and the pressing need for affordable housing. But is converting these spaces more profitable than holding out for traditional tenants in a slow recovery — or is it simply the only viable path forward in cities where demand has fundamentally changed?

The Surge in Office-to-Residential Conversions

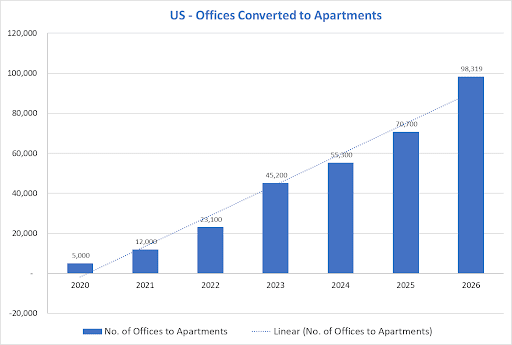

In 2025, the United States is set to witness a record-breaking 71,000 units emerge from office-to-apartment conversions, a significant increase from 23,100 in 2022, according to Rent Cafe.

This surge signals a wider national trend where adaptive reuse projects are becoming a mainstream solution to address the housing shortage. Notably, the New York metro area leads the nation with over 8,300 units in its conversion pipeline, followed by Washington, D.C., with 6,533 units.

Across Europe, this transformation is also gaining momentum. In Germany’s seven largest cities, researchers estimate that around 2.3 million square meters of current office space could be converted into housing, generating approximately 60,000 apartments for 102,000 residents, according to ifo Institut.

Similarly, in key European markets, over 30% of office property transactions in early 2025 were already earmarked for conversion — up from just 17% in 2024 — highlighting an accelerating trend toward adaptive reuse.

Given the rapid acceleration in office-to-residential conversions, I predict that the U.S. could see close to 100,000 such transformations by 2026, especially when developers can capitalize on urban housing demand and enjoy lower rebuilding cost.

Why Such a Big Surge?

The economics just make sense.

Lower Construction Costs

Converting existing office space is often cheaper than building new apartments from scratch. Adaptive reuse is often more cost-efficient than new builds; these projects can be 30% less expensive per unit than demolish-and-rebuild alternatives.

In markets with strong residential demand, adaptive reuse projects can generate 15–25% profit margins, compared to 10–20% typical of new developments.

Shorter Development Timelines

Most office-to-residential conversions can be completed in under two years, which is significantly faster than the typical three to five years required for ground-up construction. This accelerated timeline not only reduces carrying costs but also enables developers to realize returns more quickly, improving overall project cash flow and internal rate of return (IRR).

Faster Time-to-Market

Office buildings often require fewer foundational or structural changes, which minimizes construction complexity and shortens delivery schedules. This streamlined process allows developers to respond more nimbly to market demands, capitalize on favorable economic conditions, and start generating rental income sooner.

Prime Urban Locations

Many underutilized office buildings are located in dense urban cores, offering unparalleled proximity to public transit, business districts, dining, cultural venues, and other amenities that are highly attractive to renters. These central locations not only support higher occupancy rates and premium rents but also align with shifting preferences toward walkable, live-work-play environments.

Value Appreciation Potential

As urban housing demand continues to outpace supply, well-executed conversions in desirable locations tend to outperform legacy office assets in both rental yield and long-term appreciation.

Repositioning an obsolete office tower into a high-demand residential property can unlock significant untapped value, often transforming a depreciating asset into a high-performing investment.

Challenges of Conversions

While the potential for profitability in these conversions is evident, several factors influence their financial viability. The average cost of converting an office building into residential units is approximately $685 per square foot. In contrast, acquiring and converting an existing multifamily property costs about $600 per square foot. Despite the higher initial investment, conversions offer long-term benefits, including increased property value and the ability to meet the growing demand for housing.

But challenges persist; the average office building in the U.S. targeted for conversion is 72 years old, indicating that many require substantial upgrades to meet modern residential standards.

Additionally, zoning regulations and building codes can complicate the conversion process, potentially leading to delays and increased costs.

Global Implications and Future Outlook

Looking ahead, the trend of repurposing office spaces is expected to continue, driven by the dual forces of declining office demand (due to the prevalence of hybrid and remote working) and the urgent need for housing.

As urban populations grow and work patterns progress, the adaptive reuse of office buildings offers a pragmatic solution to meet these challenges.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert