London’s commercial office landscape is undergoing a significant transformation as traditional landlords increasingly package conventional leases into flexible managed service agreements. While overall desk rates rose 2% to £629 in Q3, this increase primarily reflects the introduction of premium enterprise quality managed offices rather than demand-driven growth.

“We’re witnessing a fundamental shift in how commercial office space is being packaged and marketed,” said Tom Petryshen, VP of Growth & Analytics. “As high vacancy rates and hybrid work models persist, landlords have strategically pivoted to provide flexible agreements to meet evolving market demands.”

Key Market Trends:

- Strategic Portfolio Conversion: Traditional landlords are actively transforming their portfolios, converting conventional 5-10 year leases into flexible managed solutions. This shift includes comprehensive service packages with modern fit-outs, enhanced amenities, and all-inclusive billing – directly responding to occupier demand for simplified, adaptable workspace solutions. The trend is particularly evident in London where 40% of new flexible inventory in 2024 on Rubberdesk stems from converted traditional space.

- Enterprise Space Driving Rate Growth: Premium enterprise offices (50+ desks) are reshaping market dynamics, pushing overall rates up 12% to £819 per desk. This growth reflects the introduction of higher-grade inventory rather than pure demand, as landlords position converted traditional offices with enhanced specifications and amenities for larger occupiers.

- Resilient Small Office Segment: Despite significant market changes, rates for offices with 15 or fewer desks demonstrate remarkable stability at £560 per desk. This price point resilience, particularly in areas of concentrated demand like Shoreditch and Southwark, indicates strong market fundamentals for smaller occupiers and suggests effective price discovery in this segment.

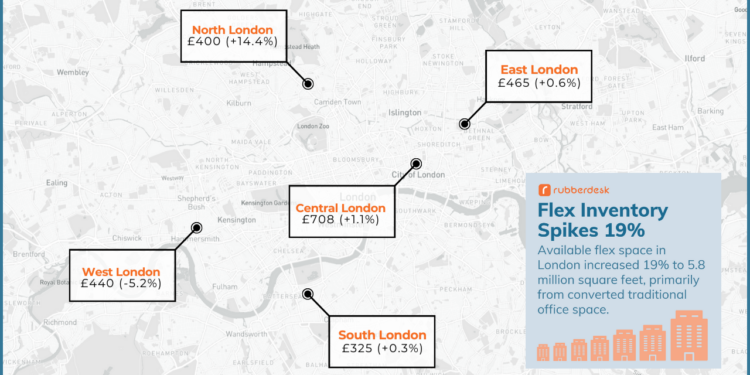

- Accelerating Supply Growth: Available flexible inventory surged 19% to 5.8 million square feet, with the majority coming from traditional office conversions. This expansion varies significantly by region, from Central London’s 29% increase to East London’s 3.5% contraction, reflecting both strategic landlord repositioning and varying levels of market maturity across London.

Market Evolution

A new category of flexible workspace has emerged as landlords partner with managed service providers, expanding the market beyond traditional coworking and serviced offices to include new spec offices that include:

- Traditional office space packaged with modern fit-outs

- Essential amenities that businesses now expect as standard

- End-to-end management services

- Simple billing and all inclusive rates

This evolution gives businesses more choice than ever before, with Rubberdesk providing a single platform to easily compare live rates and benefits across all categories – from coworking, serviced offices to these new managed solutions.

Regional Market Impact

Central London exemplifies this trend with a 29% increase in flexible inventory to 4.3 million sq ft. While enterprise office rates (50+ staff) rose 9% to £884 per desk, smaller office rates actually declined 3% to £662 per desk, reflecting the true state of market demand.

East London saw similar patterns, with enterprise offices (26+ staff) maintaining overall rates at £465 per desk, while smaller office rates decreased slightly to £420 per desk.

North London’s 14% rate increase to £400 per desk reflects the introduction of higher-grade converted space rather than organic growth, with enterprise offices actually declining 18% to £585 per desk.

West London’s experienced continued market softening with rates falling 5% to £440 per desk and inventory declining 3% to 370,150 sq ft, though larger offices (26-50 staff) bucked this trend with a 2% rate increase to £559 per desk while smaller and mid-sized offices saw significant decreases.

South London’s market offers the widest price variation in London, from premium rates in Southwark (£338-£576 per desk) to value options in Merton and Lambeth (below £227 per desk), while experiencing growth in enterprise-grade inventory across key boroughs including Wandsworth and Southwark.

Property Owner Strategy

As businesses continue to adapt their workspace strategies to hybrid models, traditional landlords are responding with more flexible solutions. This includes:

- Shorter lease terms

- Enhanced amenities

- Managed service options

- Scalable space solutions

- Turn-key office setups

“The market is responding to a structural shift in how businesses want to occupy space.” added Laura O’Sullivan, Flexible Space Specialist. “Property owners who adapt to these new demands with flexible solutions are better positioned to meet the clients growing demands.”

Market Outlook

While economic conditions show signs of improvement, the office market transformation appears to be structural rather than cyclical. The continued switch of traditional office leases to flexible managed service contracts is expected to persist as property owners meet the new market demand.

About Rubberdesk

Rubberdesk is the UK’s flexible office marketplace where tenants find current availability and pricing. With thousands of fully furnished serviced and managed office spaces on twelve month terms updated daily. Since the UK launch in early 2020, Rubberdesk now offers over 6,500 offices, an estimated 7.3 million sq. ft. of space with a capacity for over 145,000 people.

For more information:

Laura O’Sullivan

[email protected] / +447456247744

Gareth Smith

[email protected] / +447762809786