Dozens of the U.K.’s leading serviced office providers have issued a coordinated warning to the government over a sudden change to how business tax rates are being applied to flexible workspaces.

“High streets will hollow out. Growth will stall. Investment is drying up,” the letter warns. “There is no guidance and no clarity. This risks lasting damage to one of the U.K.’s most dynamic and productive sectors.”

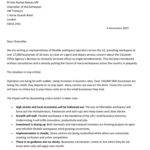

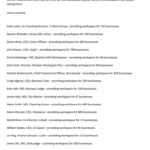

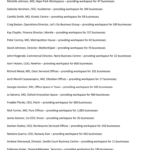

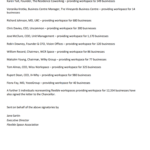

More than 60 operators — representing over 27,000 businesses — have written to Chancellor Rachel Reeves expressing “urgent and deeply serious concern” about the Valuation Office Agency’s (VOA) decision to reclassify serviced offices, business centers and coworking spaces as single hereditaments.

Loss of Small Business Rates Relief for Thousands

Under long-established practice, individual businesses occupying private offices, suites or dedicated desks received their own assessments and were often eligible for Small Business Rates Relief (SBRR). The new interpretation places the entire rating liability on workspace operators, who then become responsible for the whole building.

According to the Federation of Small Businesses, the reclassification could remove SBRR entitlement from up to 150,000 SMEs using serviced offices nationwide. Operators say the effect is already visible: some are facing sudden backdated bills, sharp increases in overheads and stalled investment plans.

One Midlands operator reported receiving a £400,000 backdated business rates bill after its individually assessed units were merged into a single rating. The operator, which requested anonymity, said that if its challenge fails, it will either need to pass the cost to dozens of small firms, or close.

Industry Says Change Is Inconsistent and Retroactive

Operators say the change is being applied unevenly around the country and, in some cases, retroactively. The Flexible Space Association (FlexSA), the sector’s trade association, said the VOA has not provided clear guidance or opened a dialog, despite numerous requests from operators and industry bodies.

In the letter to the Chancellor, FlexSA Executive Director Jane Sartin warned: “This is an existential threat to a sector that underpins the U.K.’s SME economy. The flexible workspace industry provides cost-effective, professional and scalable spaces to over 150,000 small businesses.”

“Reclassifying these spaces as single hereditaments not only misrepresents how they operate, it also strips vital support from the very businesses the Government claims to champion,” she added.

Investment Put on Hold

Richard Johnson, Managing Director of UBC, which runs 15 centers across the U.K., said the change is halting regeneration efforts.

“We were planning to invest in a new site in an area that’s only just starting to recover after years of economic stagnation,” he said. “But with these sudden changes, that investment is now on hold.”

Sector Warns of Closures, Job Losses and Reduced Workspace Supply

Operators say the combined effect of lost reliefs, inconsistent assessments and increased liability could lead to closures across an industry that supports microbusinesses, start-ups and freelancers in more than 4,000 flexible workspaces nationwide.

The open letter warns that “many centres are now on the brink,” and that without intervention “hundreds of thousands of small firms will face higher costs within weeks.”

The National Enterprise Network said the changes may “trigger widespread business failures” and hit a sector “still recovering from pandemic-related challenges.”

VOA Response and Legal Position

The VOA told The Times that developments in case law, including Prosser v Ricketts (2024), Cardtronics v Sykes (2020) and Ludgate House v Ricketts (2019), require a review of how serviced offices are assessed.

“Developments in case law have meant that we have had to review the way serviced offices are assessed,” a VOA spokesperson said. “As a result, many may now need to be treated as a single property rather than individual units, depending on their contractual arrangements.”

“We understand this could have a financial impact on operators and we are engaging with industry representatives to discuss our approach,” the VOA added. “However, we are obliged to apply the law based on the facts in each individual case.”

However, operators argue that these cases are unrelated to serviced office operations and contradict a 2023 agreement between the sector and the Government, which allowed individual valuations when exclusive occupation was demonstrated.

CBRE U.K. Rating Head Tim Attridge said “the business rates system was last modernised in 1990. The impact of the tax on sectors such as flexible workspaces has not been sufficiently considered,” and that merging and backdating assessments should pause “before the basis of valuation is established via the appropriate litigation.”

What Happens Next

With assessments underway across multiple regions, workspace operators say the next few weeks will determine whether many centers remain viable. Some have already paused hiring and expansion, and others say they may need to increase rates for their occupants immediately.

Industry bodies continue requesting meetings with Treasury Ministers. So far, operators say these requests have not been accepted.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert