The coworking revenue model is shifting.

There was a time when memberships carried the business. A healthy pipeline of dedicated desks and full-time coworking plans gave operators predictable income and stable margins.

Today, that model is fading.

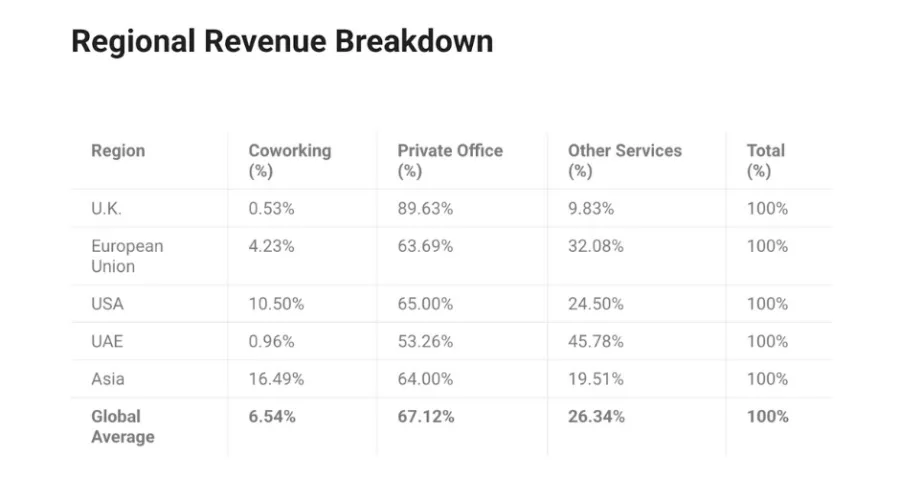

Across Coworking Compass submissions, pricing data, Virtual Office demand, and thousands of anonymized Nexudus transactions, a clear trend is emerging:

Agile operators now generate 25-45% of their revenue from ancillary services.

This shift tracks with changes in how people work, how teams meet, and how companies plan their space needs.

The impact is clear: operators leaning into this mix tend to be steadier, more profitable, and less exposed to market swings.

Why traditional membership-based revenue is declining

Across Coworking Compass submissions and industry indicators, we’re seeing:

- Members choosing flexible or hybrid memberships

- Fewer full-time desk commitments

- Higher churn from economic uncertainty

- Increased competition from public spaces and home setups

- Teams use coworking only for “collaboration days”

Memberships are far from disappearing — we’re just seeing greater diversification.

The rise of external bookings

External bookings such as hot desks, day passes, meeting rooms and ad-hoc use are becoming a more important part of operators’ revenue mix. They scale with demand, make better use of idle space and bring in people who may never take a membership. They also avoid long commitments and carry margins that often outperform seat-based products.

Industry reporting points to steady growth in these non-membership services and their role in diversifying income beyond traditional memberships. Many operators also find that first-time bookers return when the experience is simple and the offer is clear.

Dynamic pricing supports these products well. Adjusting rates for peak days, popular rooms or seasonal patterns helps capture demand more accurately without adding extra operational work.

The untapped power of virtual offices and add-on packages

One of the most under-leveraged and highest-margin opportunities in coworking today is virtual offices. With the rise of remote and hybrid working, many companies no longer need a dedicated full-time office, but still want a professional presence, flexibility, and occasional access to a workspace. That’s where a well-designed virtual product comes in.

The operators who generate the strongest non-membership revenue treat virtual offices not as a side product, but as a core recurring offering. And the most successful approach is packaging, not one-off sales.

When bundled with:

- Mail handling, scanning or forwarding

- Meeting room credits or discounted access

- A registered business address

- Occasional coworking days or day passes

- Phone or reception services

- Community directory visibility

…virtual offices become sticky, high-retention subscriptions that require almost no physical footprint.

More importantly, virtual offices consistently act as a top-of-funnel acquisition channel. Many customers who start with a virtual office plan later upgrade to meeting room bundles, coworking passes, or hybrid team packages – increasing lifetime value without increasing marketing spend.

Add-ons follow the same pattern: lockers, storage, premium internet, printing credits and digital mail services may look small individually, but collectively they increase revenue stability and reduce churn by raising perceived value.

This is where Nexudus comes in.

With Nexudus’s Virtual Offices module, operators can launch and scale a virtual office line in under an hour with automated onboarding, identity checks, mail workflows, invoicing, and mailbox management built in. It’s a low-overhead engine that lets operators monetise demand that traditional memberships no longer capture.

How top operators diversify

The highest-performing spaces in the Nexudus ecosystem share a common pattern of diversified revenue.

They focus on:

- A strong bookings engine: Meeting rooms, event spaces, training rooms, podcast studios.

- Virtual office bundles: Not sold standalone but packaged.

- Productized add-ons: Not as “extras,” but as revenue lines.

- Corporate and team passes: Especially hybrid teams.

- Community events priced for external audiences: Workshops, wellness, networking, and skills sessions.

Combined, these create a revenue portfolio that stabilizes the business, even in down cycles and makes the operator less reliant on membership churn.

How the Coworking Compass evaluates your revenue mix

Many operators know their numbers, but far fewer know what those numbers mean in the context of the wider coworking market. That’s exactly why we built the Coworking Compass.

The Compass is your shortcut to understanding how your space is really performing. It benchmarks your numbers against real-world data from comparable coworking businesses and translates them into a clear, personalized report.

You receive an overall performance score for your coworking space, including a dedicated Revenue Score.

Your Revenue Score is based on:

- Revenue distribution ratio

- Meeting room revenue as % of occupancy

- Average desk revenue

- Non-member revenue ratio

- Virtual office penetration

- Add-on sales performance

- Revenue per sqm/ft

- Revenue seasonality

You also receive:

- Benchmarking against comparable spaces

- A breakdown of “revenue vulnerabilities”

- Recommendations for diversification

The result is a practical, data-backed roadmap showing exactly where your revenue mix is strong, where it’s exposed, and where you can develop new, more resilient income streams.

If you’re ready to see how your own revenue mix stands up and where your next growth opportunities really are, the Compass is your starting point.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert