- Coworking is in demand from real estate companies, but it must be managed properly to avoid damaging real estate performance

- Gartner suggests 4 key principles that corporate real estate owners should heed in order to make coworking work

- These principles will help corporates limit cultural disruption associated with introducing coworking into their spaces

Last week, we learned that there are 4 key issues hindering the widespread adoption of coworking from heads of corporate real estate.

Corporates are aware of the benefits associated with coworking; employee wellness, flexibility, and savings. However, the decision to integrate coworking into a real estate strategy must be carefully considered. Gartner’s recent report, “Integrating Coworking Into Real Estate Portfolio Strategy”, states that “coworking spaces have great potential, but if introduced and managed improperly, they can hurt real estate performance and employee satisfaction.”

While there are things that coworking operators can do to facilitate this process; a significant amount of responsibility for the decision falls to the heads of corporate real estate. In order to make coworking work for them, Gartner suggests they follow four principles:

- Define use case

- Treat coworking as a category of spend

- Expand lease versus buy decision

- Include co-working in scenario planning.

Defining Use Cases

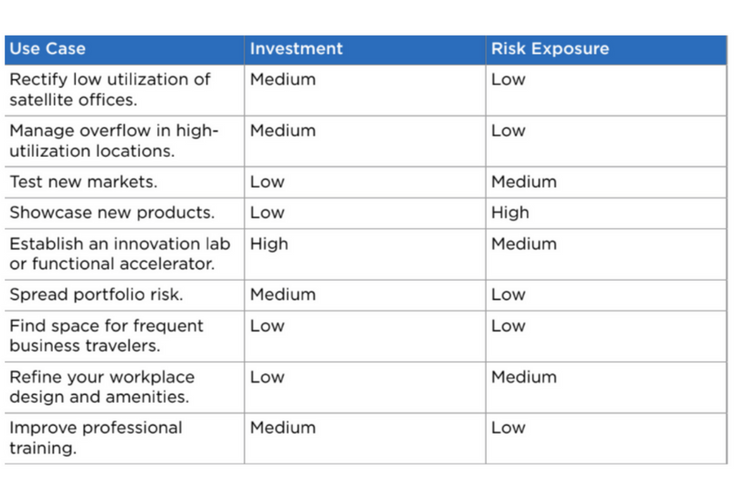

Defining use cases will help corporates limit cultural disruption associated with introducing coworking spaces. Though typically companies use coworking spaces when entering a new market or when a team is working on a specific project, Gartner argues that “coworking spaces fit many more use cases” and each use case varies in “difficulty, level of investment, and risk exposure.”

Coworking as a Category of Spend

One of the greatest benefits of coworking spaces is that it can lead to savings and to maintaining a positive cash flow. However, in order for this to happen, a clear strategy must be laid down, meaning that corporates need to truly understand their purpose for using coworking spaces. Companies should define clear metrics that will help them measure how they are spending resources in coworking, whether or not they are observing the desired results, and whether or not these results tie back to company objectives.

Expand Lease vs Buy Decision

“Instead of treating coworking spaces as a separate category of space, start incorporating coworking spaces as another space option when you make lease versus buy decisions.” Gartner expands on the topic by proposing four evaluation categories for companies to make this decision:

- Strategic importance: cost of location vs where talent is available

- Property characteristics: consider issues such as investment tolerance and the amount of changes a space might need to meet company requirements

- Occupancy issues: think about how many people you are expecting to work from one location, how long you expect the occupancy to last, what are the chances of that number growing in the short and long term, etc.

- Market issues: consider rent prices, how much available space there is in the desired location, is the desired space available for purchase, and whether your current rent will increase or not.

Scenario Planning

When you are thinking about potential scenarios for the company, heads of corporate real estate should take into consideration coworking spaces. Whether the company is examining entering a new market, whether it’s looking for additional space to deal with overflow, whether they will need a specific space for a specific project, or whether it needs to downsize, coworking can play a vital role in helping the company through these situations.

In particular, with new lease accounting standards coming into effect in 2019, companies should seriously consider coworking and flexible workspaces in their scenario planning, as it could potentially mean savings and a positive cash flow, as the new standard doesn’t require short leases to be reported.

These four principles will help companies make coworking a scalable and sustainable real estate alternative for companies of all sizes. But in order for this to work, operators should heed corporate needs in terms of security, costs, and branding.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert