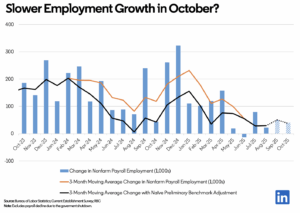

The U.S. job market cooled in October, according to LinkedIn’s November U.S. Jobs Report and consensus estimates, which show nonfarm payrolls increasing by about 40,000 jobs — down from roughly 50,000 in September.

Excluding federal workers affected by the government shutdown, that modest gain is just enough to keep the unemployment rate steady at 4.3%.

Hiring Slows Across Most Sectors

Private-sector data from ADP showed a similar story, with employment up by 42,000. Gains in trade, transportation, and utilities (+47K) and healthcare (+26K) helped offset losses in information (–17K) and professional and business services (–15K). Healthcare and social work continue to drive most of this year’s limited job growth.

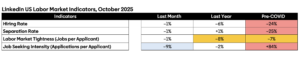

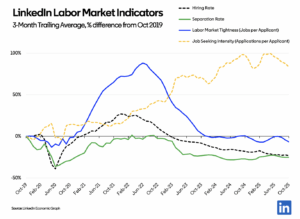

On LinkedIn, hiring dipped 0.8% from September and is down nearly 6% from a year ago, with the biggest declines in government and professional services. Retail saw a seasonal bump (+6.8%), while healthcare hiring inched up (+1.6%) but remains slightly below last year.

Openings and Layoffs Indicate a Cooler Market

Employers appear to be pulling back. Job postings fell about 5% from September and are down more than 12% year-over-year, according to LinkedIn. Indeed reports a similar trend, with postings down 6.5% compared to October 2024.

Mentions of layoffs on LinkedIn rose 7%, and the separation rate — which tracks quits — slipped slightly from September.

Labor Market Still Stable…For Now

Despite slower hiring and fewer openings, there’s little sign of a sharp downturn. The Chicago Fed’s unemployment nowcast suggests only minor softening in the labor market. Job seekers are applying for slightly fewer roles (applications per person fell 2%), hinting that most workers still feel relatively secure.

Overall, the data paints a picture of a job market that’s cooling but not collapsing. Growth has slowed to its “breakeven” pace, where employment just keeps up with labor force growth.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert