- New research by Office Hub on the Australian coworking market shows some growth in niche spaces, but the segment remains largely “untapped” as operators focus on appealing to the widest possible customer base.

- The report found significant demand from enterprise-level clients and corporates, as the coworking market appears to be moving away from startups and freelancers.

- There is also high take-up in longer term contracts when incentives are offered, suggesting that clients appear to value low prices over the flexibility of shorter leases.

Office Hub recently published its 2018-2019 Australian Coworking Market Report, which considers the growth and evolution of the flexible workspace sector in Australia over the past year. The report found five key trends spearheading the growth of the industry in the region.

1. ‘Generation Flex’ is calling the shots in corporate workspace strategy

A culture shift has prioritised activity-based working and collaboration in the workplace, fuelling the rise of flexible workspace strategy at the corporate and enterprise level.

2. Soaring confidence in Australian market from global operators

As they continue to lease more commercial space and open thousands of square metres in capital cities, major players are displaying fresh confidence in Australia’s flexible segment.

3. The rise of niche and industry-specific spaces

As more operators enter Australia, there is a growing precedence for industry-specific spaces, gender-focused offices and other specialisations as operators strive to find a niche in an oversupplied sector.

4. Fresh uptake of peer-to-peer office sharing

The peer-to-peer economy is fuelling considerable growth in office sharing, with more than 39 per cent of workspace deals in Australia in the peer-to-peer segment.

5. Activity-based styles of work are informing design movement

Operators are reinvesting to meet evolutions in working style, with private offices, collaborative breakout zones and natural light defined as the key design trends of 2019-20.

These trends closely align with what the industry is experiencing in more mature markets like the US, UK, and China, where operators are increasingly focusing on design and service sophistication in order to differentiate themselves from their competitors.

Flexible Workspace User Profile in Australia

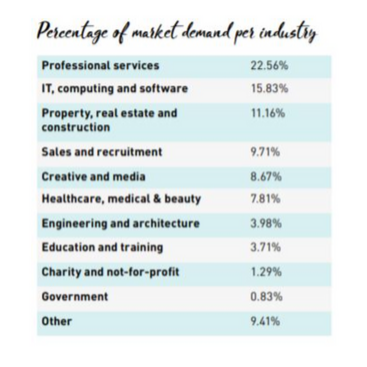

According to the report, “little has changed in terms of the business industries utilising flexible office space around Australia.” However, what does need to be noted is that “the typical coworking profile in Australia seems to no longer be startups or entrepreneurs, but established companies seeking benefits beyond the simple ability to grow within a space.”

As in other major markets, the majority of flexible workspace users are looking for private workspaces (over 80% in Australia), as open plan workspaces continue to face backlash for their lack of privacy.

The report also found indications that price could be more important than flexibility for most tenants.

The average lease time in Australia remains between 7 and 8 months, however “from initial enquiry through to signed contracts, the overwhelming market preference is for 12 months.” According to Office Hub, this is due to the fact that coworking operators often incentivise 12-month commitments with a reduction in overall cost, and the increased uptake of this offer means that people are willing to sacrifice flexibility to save money.

Why Coworking?

Office Hub examined the key motivators to get people and companies to move into new workspaces. The top motivators include:

- Geographical location (20.98%)

- Business expansion (17.58%)

- Lease ending (11.37%)

- Moving out of a home office (10.43%)

- New branch office (8.58%)

- New business or startup (7.58%)

- Temporary space (4.69%)

- Upgrading office (3.83%)

- Need less space (3.27%)

- Save money (2.96)

Coworking in Australia: A Brief Picture

One growing trend in the flexible workspace industry is the rise in niche spaces across global markets. While there are a handful of niche spaces in Australia, “the niche segment remains (mostly) untapped” as operators continue to focus on appealing to the widest possible customer base.

This is expected to change as the market continues to grow and space operators face the need to deliver to a more closely defined customer persona.

Suggested Reading: “How to Build a Customer Persona for Your Coworking Space”

- Sydney: Office Hub found that Sydney remains the focal point of the country’s flexible workspace industry. However, with global players entering the market, prices have dropped with the average contract value dropping 18.88%.

- Melbourne: The Melbourne market “has entered a second stage of maturity” as more enquiries for more than 40+ continue to increase. In Victoria specifically, the market is divided into two segments, big operators that target the corporate market and local operators that continue to service entrepreneurs and freelancers.

- Brisbane: Growth in Brisbane is attributed, in large part, to the 5.72% fall in average contract values, which increased the uptake of flexible space.

- Adelaide: The industry is expected to grow in Adelaide with renewed economic confidence and with commercial vacancy rates dropping to their lowest levels in more than three years.

- Perth: Perth’s flexible workspace market is set for transformation as global players, including Spaces and WeWork, enter the market. Prices are expected to drop in this area as global players seek to fill up their spaces.

- Canberra: While price drops played a key role in driving the market in Brisbane, the opposite is true in Canberra, where tenants display a clear preference for quality over affordability, with the average contract value sitting around $7,500.

You can read Office Hub’s full report here.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert