- At GCUC UK 2019, James Rankin from the Instant Group and Carston Foertsch from Deskmag revealed the latest industry findings.

- The session focused on what makes flexible workspaces profitable, along with data on UK market growth.

- Speakers also referred to research on what Millennials really want from their workspace, and how they differ from previous generations.

What do occupiers expect from our industry in 2019? What’s prompting larger companies to “buy in”? How many coworking spaces actually make a profit…?

James Rankin, Research Director at the Instant Group and Carston Foertsch, Founder & Editor at Deskmag, provided us with answers to these questions and many more during GCUC UK’s ‘Coworking By Numbers’ speech this September.

Instant Group’s recent UK-focused research reveals the following:

1. We live closer to coworking spaces than ever before

Coworking spaces are becoming more accessible, with 80% of the UK population living within a 30 minute commute of a coworking space.

The UK is more developed than most markets and there’s been a gradual expansion across the country – especially in secondary towns and cities.

2. There’s more demand for larger requirements

The recent growth of larger requirements can be partly attributed to the fact that big companies just don’t last as long anymore.

In fact, the average lifespan of an S&P 500 index company has decreased from 67 years in the 1920s to just 15 years today, according to Professor Richard Foster from Yale University.

Simply put, CEOs can no longer predict where their business will be in three years time, so for many firms a ten year lease just doesn’t make sense.

3. The CRE journey is changing

The types of employees tasked with searching for a new workspace is changing. A number of different people are now taking the helm, not just owners and CEOs. This includes:

- C-level

- Director

- Executive Assistant

- Admin Assistant

- Owner

- Manager

4. 7% of all UK workspace is flexible

This is set to rise to 13% by 2023, according to data provided by Costar for 2019.

5. Today’s occupiers expect more…

…and according to research, Millennials expect more than other age groups (there aren’t enough Gen Z-ers in the workplace yet to make them a focus of study).

Regardless of age, most occupiers expect formal and informal meeting areas and a relaxation space. Interestingly, only 39% of non-Millennials expect a fitness space compared with 62% of Millennials.

Todays customer only expects more

Keep up-to-date with Instant Group’s research reports here.

What Makes a Coworking Space Profitable?

Meanwhile, Deskmag’s 2019 Global Coworking Survey focuses on the profitability of coworking spaces. Among other things, it reveals:

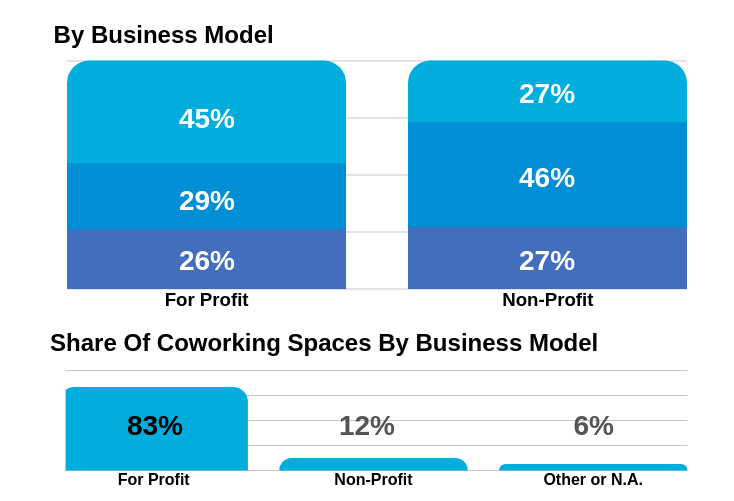

1. Non-profits make less than for-profits

Which is unsurprising, but it’s interesting to note that a similar percentage of coworking spaces from both models are unprofitable. Of the spaces that took part in the survey, 72% of profitable spaces plan to expand compared with 48% of unprofitable spaces.

2. Private offices equals higher revenue

Profitable coworking spaces gave their revenue stream a huge boost (37%) by renting out private offices. Renting out private offices now surpasses renting out desks and combined membership plans for profitability (35%). Today, around one in nine coworking spaces rent out more than 60% of its space as private offices.

3. The more locations the merrier

Operators with three or more locations are more likely to record a profit than in previous years (over 70% in 2019). Only one in three coworking spaces with one location are profitable which has been the case for a number of years.

4. Management agreements can have a huge impact

Coworking spaces that have a management agreement with the person who owns the building are often much more profitable than other models.

5. Location, location, location

This year, the largest proportion (55%) of profitable coworking spaces can still be found in large cities with more than one million inhabitants. This figure rose significantly from the previous year, whereas small cities saw a small decrease or a tiny increase. 30% of coworking spaces in small towns are proving profitable which has increased since last year.

Read the full set of results here.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert