- A new report by Office Freedom has found that new flexible workspaces in Central London have grown 42% year-on-year.

- Growing demand is being met by increased supply resulting in ever more competitive rates.

- Based on its data, Office Freedom endorses industry estimates that 30% of corporate real estate will be flexible workspace by 2030.

The number of new flexible working locations in Central London has grown 42% year-on-year. That’s the main finding in a new report by flexible office specialist, Office Freedom and evidences that the growing trend towards flexible workspaces shows no signs of slowing. The office space consultancy tracked 155 new business centres opening in 2018, a 42% increase year on year.

The report also reveals that the growth is driving ever more competitive rates, lowering the cost of all kinds of office spaces within the capital. Over the last two years, office prices in Hammersmith have fallen by 29%, whilst Paddington is 32% cheaper as a direct result of greater flexible space availability. The rates in prestigious Knightsbridge are still amongst the highest in Central London, but have dropped by 38% between 2014 and 2018.

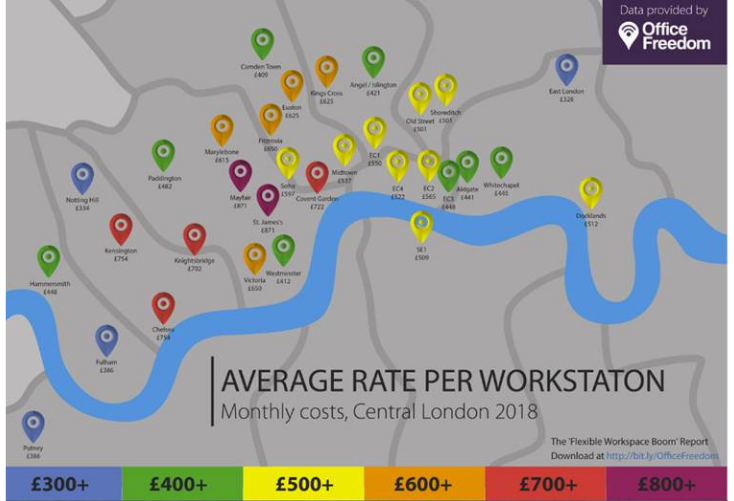

Richard Smith, CEO of Office Freedom comments: “The increase in availability of flexible working spaces from new operators and attractive terms have maintained pressure on workstation rates. Whilst areas such as Mayfair and Knightsbridge continue to demand the highest average workstation rates at nearly £900, rates can be as low as just £328 in East London.”

He continues: “Flexible workspaces are booming and we are seeing more and more large corporates, such as Amazon, Facebook and Microsoft embracing the benefits that flexible workspaces bring. Savvy businesses, large and small, can easily look at the average workstation rates and see where they can make substantial savings.”

The changing structure and dynamics of office life has seen workspaces become more fluid and adaptable environments. As part of this change, flexible workspaces are rising in popularity, providing fully-equipped offices ready for immediate use. With increasing demand and decreasing costs, Office Freedom endorses industry estimates that 30% of corporate real estate will be flexible workspace by 2030 and that London is now the world’s ‘capital’ for flexible working spaces.

Richard Smith points to employers’ reluctance to lease property for long periods of time, commenting: “There are market uncertainties due to Brexit, but businesses increasingly want to be able to react to whatever conditions they face. Flexible workspaces allow businesses to scale up or down on demand and only pay for the space they need.”

Office Freedom also links the boom in flexible office space take-up to changes in accounting standards. The revised standards bring future lease obligations onto the balance sheet and therefore makes short term flexible leases more attractive. Companies are considering the balance sheet and profit and loss impacts of a ten year lease compared with those of flexible offices and this is now a key financial consideration.

What’s more with 95% of workers citing the office environment as being important to their wellbeing and mental health, Richard Smith believes that flexible workspaces can offer employers a real boost. “Companies appreciate the link between modern workspaces and employee productivity and wellness, and the right environment can have a beneficial effect on staff recruitment and retention.”

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Cat Johnson – Coworking Marketing Maven

Cat Johnson – Coworking Marketing Maven Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Andrea Pirrotti-Dranchak – Competitive Advantage

Andrea Pirrotti-Dranchak – Competitive Advantage Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert Jeremy Fennema – Tech Innovation Alchemist

Jeremy Fennema – Tech Innovation Alchemist