As the flexible workspace industry matures, Coworking is a barometer of how work culture is evolving across the globe. It represents freedom, collaboration, and adaptability. But when you look at the numbers — particularly in more established markets — coworking isn’t pulling its financial weight.

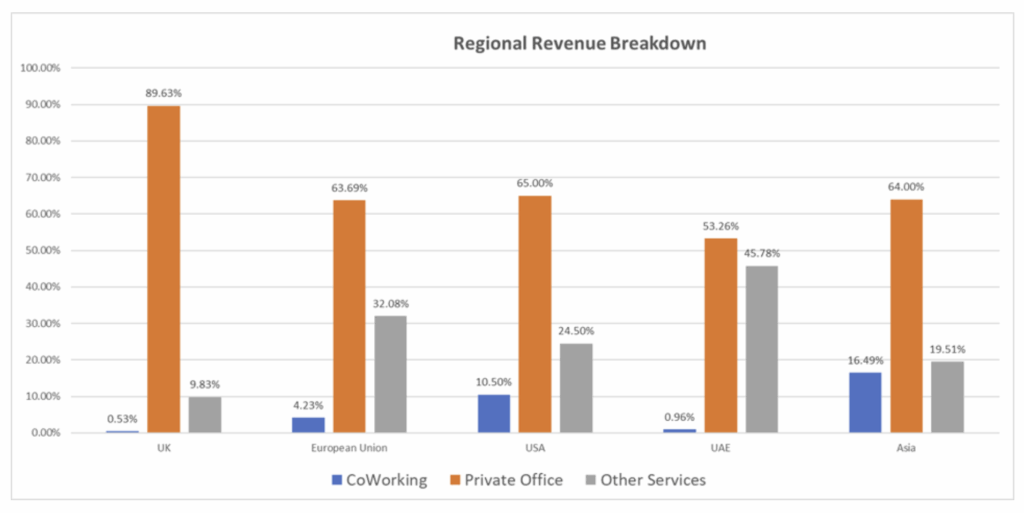

I analyzed data from about 100 coworking and flex space sites worldwide to see how revenue is distributed across key service categories. The table below illustrates the share of total income attributed to “Coworking,” “Private Office,” and “Other Services” — offering a snapshot of how operators monetize space and services across global markets.

The Global Coworking Economy: A Regional Deep Dive into Flex Space Revenue

The results of the coworking revenue data reveal not only economic trends, but also cultural attitudes toward collaboration, autonomy, and innovation.

Regional Revenue Breakdown

| Region | Coworking (%) | Private Office (%) | Other Services (%) | Total (%) |

| U.K. | 0.53% | 89.63% | 9.83% | 100% |

| European Union | 4.23% | 63.69% | 32.08% | 100% |

| USA | 10.50% | 65.00% | 24.50% | 100% |

| UAE | 0.96% | 53.26% | 45.78% | 100% |

| Asia | 16.49% | 64.00% | 19.51% | 100% |

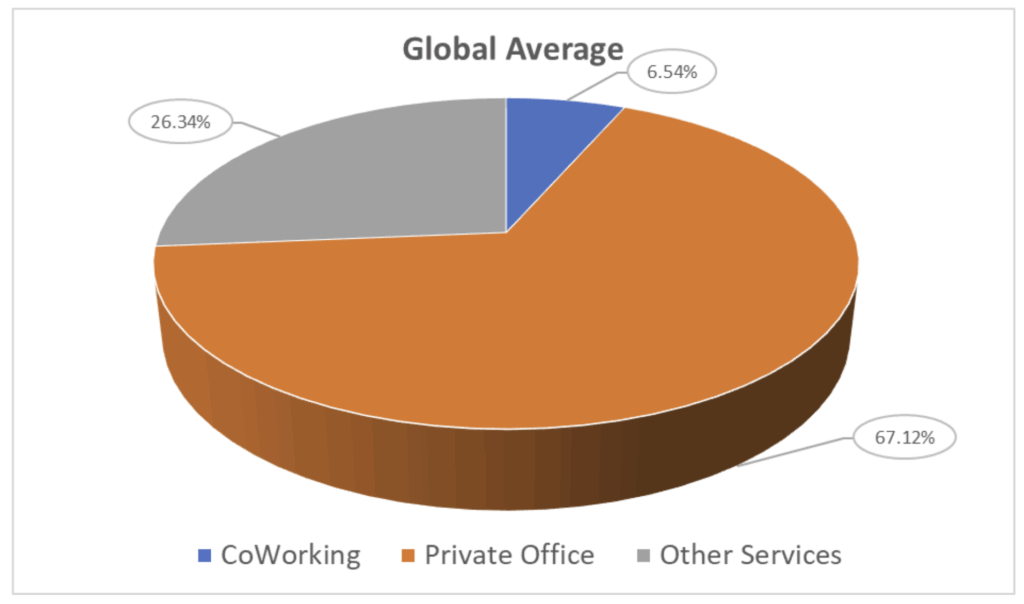

| Global Average | 6.54% | 67.12% | 26.34% | 100% |

Coworking: More Than Just Desks—A Cultural Indicator

Coworking revenue varies dramatically across regions, and that variance speaks volumes. Asia leads with 16.49% of total revenue coming from coworking memberships, which is a clear signal of a thriving ecosystem of startups, freelancers, and remote teams.

This high share suggests that coworking in Asia is a cultural norm embedded in the rhythm of modern work.

The U.S. follows with 10.50%, reflecting a strong appetite for flexibility, community, and entrepreneurial energy. American coworking spaces often double as incubators, networking hubs, and creative studios — making them more than just real estate plays.

In contrast, the U.K. and UAE report minimal coworking revenue — 0.53% and 0.96%, respectively. These figures may reflect more traditional work cultures or a strategic pivot by operators toward private offices and bundled services.

But they also raise questions: Is coworking under-leveraged in these markets? Could a renewed focus on community and collaboration unlock new growth?

Private Offices: The Revenue Anchor

Private Offices: The Revenue Anchor

Private offices remain the dominant revenue stream globally, accounting for 67.12% of income on average. The U.K.’s 89.63% share is particularly striking, suggesting a strong preference for enclosed, dedicated workspaces.

This may reflect post-pandemic caution, corporate expectations, or simply a mature market where coworking is seen as a gateway, not a destination.

Other Services: The Quiet Powerhouse

From virtual offices to event space, Other Services contribute 26.34% of global revenue. The UAE leads with 45.78%, showcasing a diversified model that blends hospitality, business support, and premium amenities.

The EU also performs strongly here, with 32.08%, indicating that European operators are monetizing beyond square footage.

Coworking’s Strategic Value Beyond Revenue Share

While coworking spaces represent just 6.54% of global revenue across the flex space sector, their strategic importance far outweighs their financial footprint. These shared environments serve as critical entry points for startups, freelancers, and growing teams — offering accessible infrastructure, community, and brand exposure. For many operators, coworking functions not only as a feeder into private office upgrades but also as a powerful marketing engine, attracting early-stage businesses that often evolve into long-term tenants.

In this way, coworking is less a revenue category and more a growth catalyst.

Strategic Takeaways for Operators

Strategic Takeaways for Operators

Coworking is a signal of how people want to work, so operators should consider:

- Doubling down on coworking in Asia and the USA, where demand is strong and cultural fit is high

- Reimagining coworking in the U.K. and UAE, perhaps through curated communities, hybrid memberships, or niche offerings

- Using coworking as a brand differentiator, even in markets where private offices dominate, because it builds visibility, engagement, and long-term loyalty.

Coworking is a product, but it’s also a philosophy. It reflects openness, agility, and the human need to connect. While private offices may pay the bills, coworking builds the brand. And in a world where work is increasingly fluid, that brand equity may be the most valuable asset of all.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert