- Interest in coworking spaces explodes south of the river

- WeWork’s major acquisition has an effect on the City of London’s workspaces

- Migration patterns across London are a result of a maturing startup space

The times they are a-changin’ for London’s coworking scene. Research from coworking marketplace Hubble reveals that the once-established hotspots have started to cool off as startups set up shop in different areas of the city.

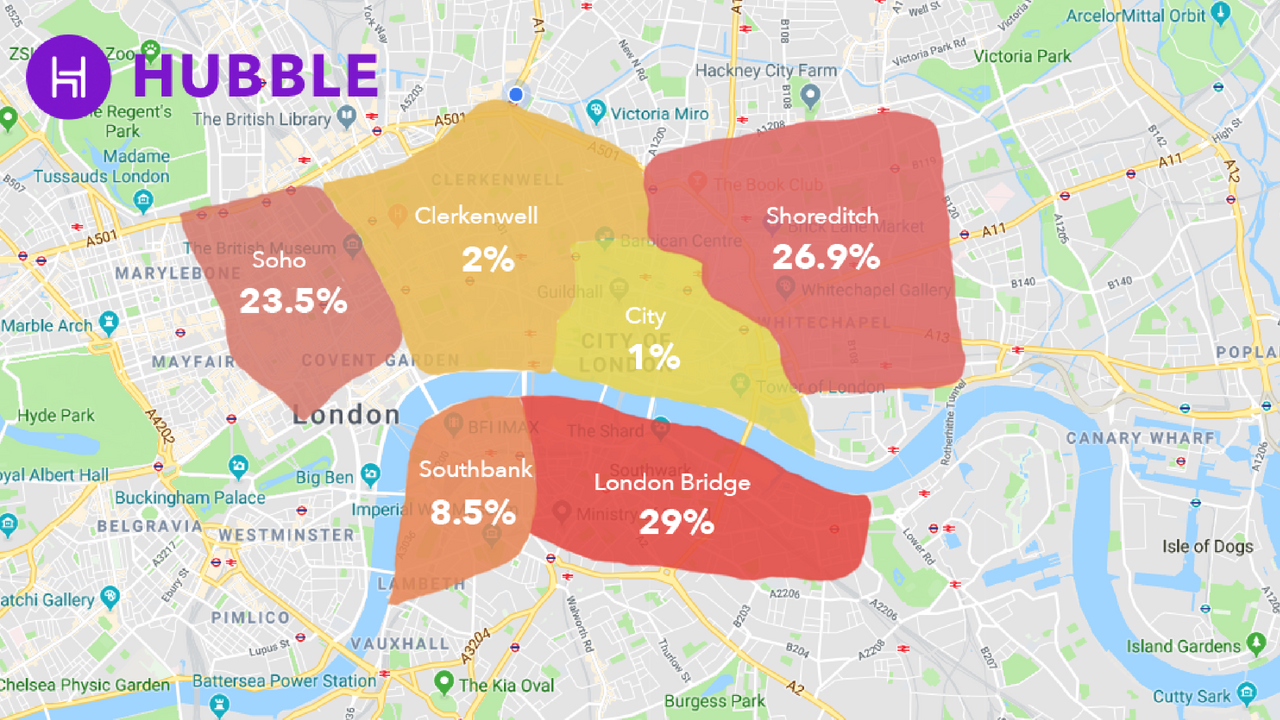

Peaks and troughs in Hubble’s search activity reveal that the City of London’s financial district is starting to tip its toe into the coworking world with a rise in popularity from 0.2% of all searches in 2017 to 1% of searches in 2018.

This small but significant increase is indicative of a wider trend as the City of London is reportedly looking to attract more startups into the Square Mile. So, a fledgling interest in coworking and flexible workspaces seems a natural step.

Hubble CEO and co-founder, Tushar Agarwal, said: “Prices for flexible leases on office space in the City of London have become more competitive, there’s greater availability as new providers step in, and the location is ideal for FinTech companies.”

WeWork has also taken a £58m stake in the sprawling Devonshire Square complex in the City of London. The site made headlines as the biggest acquisition for the coworking group, and the deal turned WeWork into the largest office space occupier in the capital last year, after the government, according to reports in The Times.

The effect this will have on coworking in the City of London is unknown. On the one hand, the Global Coworking Survey found WeWork harms 40% of all coworking spaces in its vicinity. On the other hand, take-up of coworking spaces in the UK’s largest cities outside of London also jumped from 2% to 7.5% of all leases in 2017, powered by growth of WeWork and Spaces, according to research from Cushman & Wakefield.

However, the Global Coworking Survey also points out that profitable spaces don’t feel threatened by WeWork setting up in their neighbourhood. So, WeWork’s nearest rival in the Square Mile, which is the rather swanky Clubhouse space, doesn’t need to worry.

What will be more interesting is to see how (and if) the City of London continues to embrace coworking.

London Bridge is Burning Down Bright

Not all areas of London are seeing increasing interest in coworking. The Soho and Clerkenwell regions dropped dramatically (from 45% to 24% and from 26.7% to 2% of all searches respectively).

Agarwal said: “The movement of startups and SMEs away from established creative clusters like Soho and Clerkenwell to new areas is a sign of a maturing scale-up market. Fast growing businesses are increasingly comfortable to move to newer, developing areas, and are happy to base their choices on price, transport and the preferences of their staff. There’s also been a real proliferation of flexible office space in new areas.”

However, London Bridge has seen a dramatic rise in popularity from 3.7% of all searches in 2017 to 29% of searches in 2018, and the stats for Southbank have doubled from 4% to 8.5%.

Agarwal explained why this may be the case: “London Bridge and the Southbank have transformed over the past couple of years with great bars and restaurants, better infrastructure, and more flexible office space. The area was previously known for being dominated by the public sector. Now it has become a truly diverse London market drawing in tech and media companies and corporates alike, including News International, Omnicom and Ogilvy. The introduction of the Crossrail and cheaper prices are also likely fuelling this growth.”

Hipster stronghold Shoreditch is also showing steady growth, from 15% to 27%, as Agarwal added: “I think we’ll continue to see businesses move across London to new and up and coming areas. Shoreditch has a vibrant startup scene, which will continue to attract startups but other options are opening out too.”

Wherever the pull for coworking prominence ends in the UK capital, London will remain a dominant force in the flexible work industry.

“There’s a growing appetite for flexible workspace across the UK because it’s a great model for any startup or SME that plans to scale. I think we’ll see the market for flexible work continue to flourish nationwide. That said, London does still dominate the shared workspace area, not just in the UK but on a global basis. Reports show London to be a bigger market for coworking space than New York in terms of the amount of space available and the number of providers,” Agarwal concluded.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Nirit Cohen – WorkFutures

Nirit Cohen – WorkFutures Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert