Reports have revealed that WeWork has agreed to a takeover deal from its largest shareholder and backer SoftBank that will value the coworking firm at $7.5 billion and $8 billion.

WeWork’s board had previously been weighing whether to go with this deal, or a bailout package led by JPMorgan Chase.

While nothing has been set in stone, the deal would include SoftBank spending $4 billion to $5 billion on a combination of new debt, equity and the purchase of shares. If the current framework for the deal stays, SoftBank will end up with at least a 70% stake in WeWork, with some of the shares coming from former CEO Adam Neumann.

Although Neumann’s ownership shares have been slashed down, he still maintains control to be the decision maker on a sale deal.

Despite WeWork’s knight in shining armor swooping in to save the firm, it is still expected to lay off nearly 13% of its employees.

So far, SoftBank has invested up to $10 billion into WeWork through its Vision Fund, but the new takeover deal would be executed by SoftBank’s central business and led by former Sprint CEO Marcelo Claure.

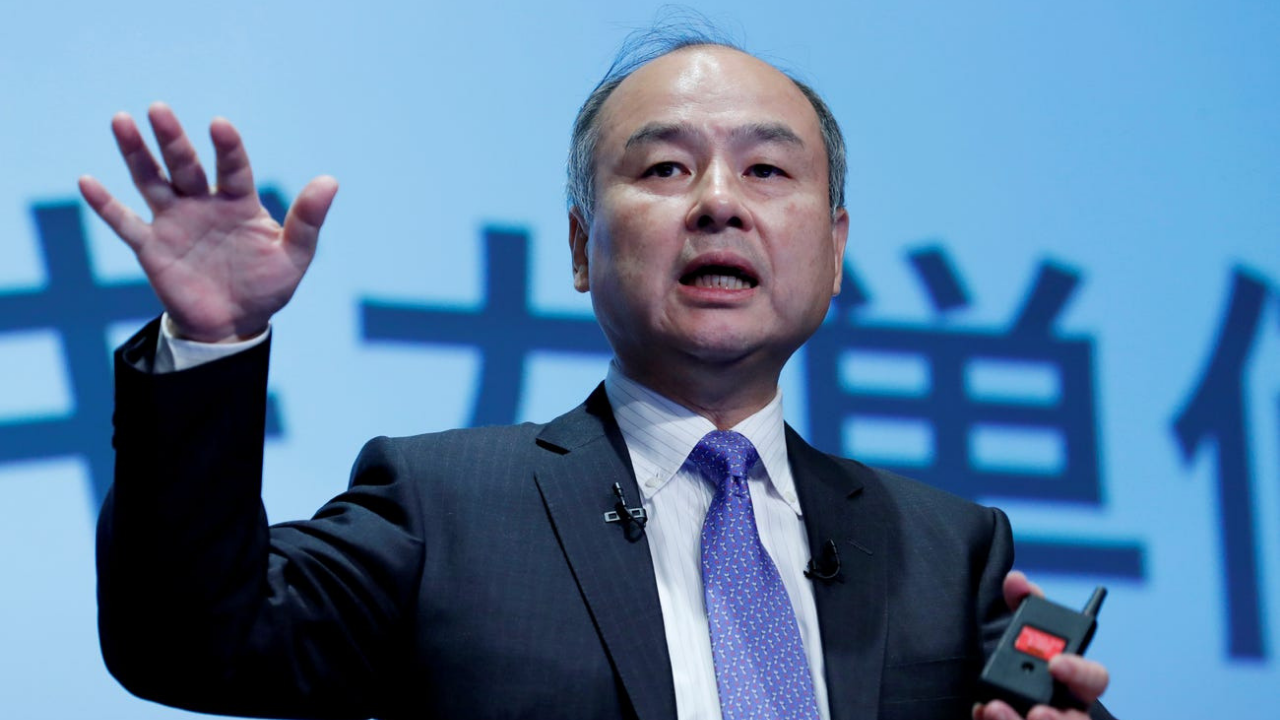

SoftBank’s Masayoshi Son will reportedly pay Neumann $200 million for the takeover bid, where he would give up his voting shares and his seat on the We Company’s board.

Dr. Gleb Tsipursky – The Office Whisperer

Dr. Gleb Tsipursky – The Office Whisperer Cat Johnson – Coworking Marketing Maven

Cat Johnson – Coworking Marketing Maven Angela Howard – Culture Expert

Angela Howard – Culture Expert Drew Jones – Design & Innovation

Drew Jones – Design & Innovation Andrea Pirrotti-Dranchak – Competitive Advantage

Andrea Pirrotti-Dranchak – Competitive Advantage Jonathan Price – CRE & Flex Expert

Jonathan Price – CRE & Flex Expert Jeremy Fennema – Tech Innovation Alchemist

Jeremy Fennema – Tech Innovation Alchemist